click to enlarge

click to enlargeIn this article, we move on to small cap blend ETFs with the goal of providing the same ranking.

We rank and determine a cutoff based on trading volume for liquidity and lowtrading friction, then rank them based on their returns and assign a score. We start with a fuller list of small cap blend ETFs:

| Symbol | Name |

| IWM | iShares Russell 2000 Index |

| IJR | iShares S&P SmallCap 600 Index |

| VB | Vanguard Small Cap ETF |

| IWC | iShares Russell Microcap Index |

| SCHA | Schwab U.S. Small-Cap ETF |

| PRFZ | PowerShares FTSE RAFI US 1500 |

| JKJ | iShares Morningstar Small Core |

| RWJ | RevenueShares Small Cap |

| PZI | PowerShares Zacks Micro Cap |

| FYX | First Trust Small Cap Core Alp |

| FDM | First Trust Dow Jones Select M |

| SLY | SPDR S&P 600 Small Cap ETF |

| WMCR | Wilshire Micro-Cap ETF |

| VTWO | Vanguard Russell 2000 Index ET |

| PJM | PowerShares Dynamic Small Cap |

| EWRS | Rydex Russell 2000 Equal Weigh |

| VIOO | Vanguard S&P Small-Cap 600 Ind |

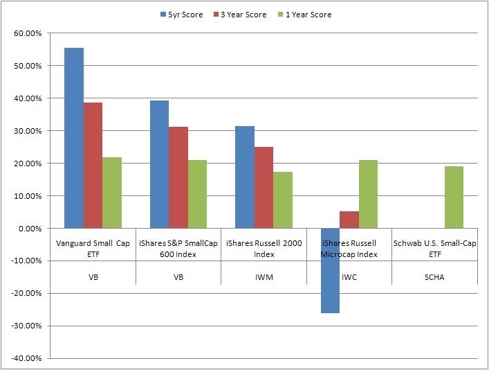

We now apply trading volume data for us to be able to reduce the number of ETFs that we examine. We want to make sure we maximize liquidity and minimize trading friction. We are going to draw the line at around 200,000 although we will let the Schwab ETF squeak in just under the bar at around 190,000. This gives us five ETFs.

| Ticker | Description | 5 Yr AR% | 3yr AR% | 1yr AR% |

| VB | Vanguard Small Cap ETF | 4.00% | 5.40% | 37.07% |

| IJR | iShares S&P SmallCap 600 Idx | 2.83% | 4.37% | 35.61% |

| IWM | iShares Russell 2000 Index | 2.26% | 3.50% | 29.63% |

| IWC | iShares Russell Microcap Index | -1.89% | 0.74% | 35.77% |

| SCHA | Schwab U.S. Small-Cap ETF | 0.00% | 0.00% | 32.36% |

We will select the top three although VB and IJR seem to be head and shoulders above the rest of the bunch.

| Ticker | Property | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| VB | Draw Down(%) | 12.00 | 9.04 | 13.15 | 13.31 | 51.92 | 32.54 | 20.01 | 3.69 |

| Return(%) | 15.29 | 7.10 | 15.50 | 0.96 | (37.61) | 36.39 | 28.58 | 3.19 | |

| IJR | Draw Down(%) | 11.07 | 10.94 | 13.98 | 14.44 | 48.42 | 33.34 | 19.29 | 3.58 |

| Return(%) | 21.43 | 6.57 | 14.17 | (1.47) | (31.70) | 24.45 | 27.33 | 2.13 | |

| IWM | Draw Down(%) | 14.41 | 12.16 | 14.14 | 13.90 | 49.44 | 32.90 | 20.09 | 4.23 |

| Return(%) | 16.88 | 3.04 | 16.95 | (2.73) | (34.48) | 26.81 | 26.49 | 1.55 |

So VB and IJR are selected for Mid Cap Blend ETFs.

I have no positions in any stocks mentioned, but plan to initiate a long position in IWM over the next 10 days.

That sounds like an excellent exchange traded fund.

ReplyDelete