Every so often, a well-meaning individual or publication will come along and espouse the idea that long-term investors should invest 100% of their portfolios in equities. Not surprisingly, this idea is most widely promulgated near the end of a long bull trend in the U.S. stock market. Consider this article as a pre-emptive strike against this appealing, but potentially dangerous, idea.

The Case for 100% Equities

The main argument advanced by proponents of a 100% equities strategy is simple and straightforward:

"In the long run, equities outperform bonds and cash; therefore, allocating your entire portfolio to stocks will maximize your returns."

To back up their views, supporters for this view point to the widely used Ibbotson Associates historical data, which "proves" that stocks have generated greater returns than bonds, which in turn have generated higher returns than cash. Many investors - from experienced professionals to naive amateurs - accept these assertions without giving the idea any further thought. (For an in-depth view of this topic, see The Stock Market: A Look Back.)

While such statements and historical data points may be true to an extent, investors should delve a little deeper into the rationale behind - and potential ramifications of - a 100% equity strategy.

The Problem With 100% Equities

The oft-cited Ibbotson data is not very robust. It covers only one particular time period (1926-present day) in a single country - the United States. Throughout history, other less-fortunate countries have had their entire public stock markets virtually disappear, generating 100% losses for investors with 100% equity allocations. Even if the future eventually brought great returns, compounded growth on $0 doesn't amount to much. (To read more about Ibbotson's theories, see Investors Need A Good WACC.)

It is probably unwise to base your investment strategy on a doomsday scenario, however, so let's assume that the future will look somewhat like the relatively benign past. The 100% equity prescription is still problematic because although stocks may outperform bonds and cash in the long run, you could go nearly broke in the short run!

Market Crashes

For example, let's assume you had implemented such a strategy in late 1972 and placed your entire savings into the stock market. Over the next two years, the U.S. stock market crashed and lost about 40% of its value. During that time, it may have been difficult to withdraw even a modest 5% per year from your savings to take care of relatively common expenses, such as purchasing a car, meeting unexpected expenses, or paying a portion of your child's college tuition, because your life savings would have almost been cut in half in just two years! That is an unacceptable outcome for most investors and one from which it would be very tough to rebound. Keep in mind that the crash in 1973-1974 wasn't the most severe crash, considering the scenario that investors experienced during 1929-31. (To learn more about crashes, see The Greatest Market Crashes and How do investors lose money when the stock market crashes?)

Of course, proponents of all-equities-all-the-time argue that if investors simply stay the course, they will eventually recover those losses and earn much more. However, this assumes that investors can stay the course and not abandon their strategy - meaning they must ignore the prevailing "wisdom", the resulting dire predictions and take absolutely no action in response to depressing market conditions. We could all share a hearty laugh at this assumption, because it can be extremely difficult for most investors to maintain an out-of-favor strategy for six months, let alone for many years.

Inflation and Deflation

Another problem with the 100% equities strategy is that it provides little or no protection against the two greatest threats to any long-term pool of money: inflation and deflation.

Inflation is a rise in general price levels that erodes the purchasing power of your portfolio. Deflation is the opposite, defined as a broad decline in prices and asset values, usually caused by a depression, severe recession, or other major economic disruption (think Japan in the 1990s). (To learn more about inflation and deflation, see All About Inflation and What does deflation mean to investors?)

Equities generally perform poorly if the economy is under siege by either of these two monsters. Even a rumored sighting can inflict significant damage to stocks. Therefore, the smart investor incorporates protection - or hedges - into his or her portfolio to guard against these two significant threats. Real assets - real estate (in certain cases), energy, infrastructure, commodities, inflation-linked bonds, and/or gold - could provide a good hedge against inflation. Likewise, an allocation to long-term, non-callable U.S. Treasury bonds provides the best hedge against deflation, recession, or depression. (Read more about hedges in A Beginner's Guide To Hedging, Introduction To Hedge Funds - Part One and Part Two.)

Fiduciary Standards

One final cautionary word on a 100% stocks strategy: If you manage money for someone other than yourself, you are subject to fiduciary standards. One of the main pillars of fiduciary care and prudence is the practice of diversification to minimize the risk of large losses. In the absence of extraordinary circumstances, a fiduciary is required to diversify across asset classes. Would you like to argue before a judge or jury that your one-asset-class portfolio was sufficiently diversified shortly after it loses 40-50% of its value? "But, your honor, if you just wait eight to 10 years …" Odds are you would soon be wearing an orange jumpsuit and making new friends in an exercise yard.

Solution

So if 100% equities is not the optimal solution for a long-term portfolio, what is? An equity-dominated portfolio, despite my cautionary counter arguments above, is reasonable if you assume that equities will outperform bonds and cash over most long-term periods. However, your portfolio should be widely diversified across multiple asset classes: U.S. equities, long-term U.S. Treasuries, international equities, emerging markets debt and equities, real assets and even junk bonds. If you are fortunate enough to be a qualified and accredited investor, your asset allocation should also include a healthy dose of alternative investments - venture capital, buyouts, hedge funds and timber. (To learn more, read The Pros And Cons Of Alternative Investments.)

This more diverse portfolio can be expected to reduce volatility, provide some protection against inflation and deflation, and enable you to stay the course during difficult market environments - all while sacrificing little in the way of returns.

Disclosure I am long the stock market

Disclosure None

Disclosure None

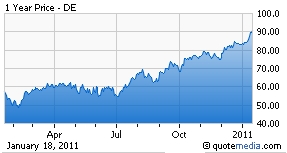

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.