Over the past year, we have repeatedly stated how bullish we are of various commodities, especially rare earths, uranium and potash. Some investors believe that many commodities have run their course, and have minimal upside remaining while possessing considerable downside from current highs. Although we disagree with this thinking, we respect the conservative approach and help our clients find ‘de-risked’ plays to participate in bull markets. We believe that conservative investors who believe that the future may not be all roses for the fertilizer industry may find Deere & Company (DE) a suitable alternative.

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.

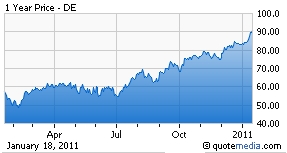

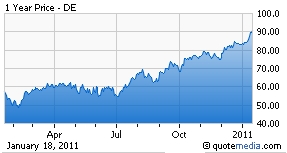

The stock currently trades just below its 52-week high of 89.97 and sports a price-to-earnings ratio of about 20 on a trailing twelve months basis. This is also a company currently paying a yearly dividend of $1.40 per share, or roughly a 1.6% yield. We expect that the company will raise the dividend twice this year based off of their operating results.

We believe that the company will be able to raise the dividend rates further this year due to strong earnings growth resulting from the bumper harvests these farmers are having in the United States. Here in South Carolina, we noticed fields of cotton not getting harvested on time and watched in amazement as the farmers allowed the crop to deteriorate. As it turns out, these were the farmers who pay others to harvest their crops, and thus do not own their own equipment; sometimes there are co-ops that perform this function as well. We did notice something very exciting driving through cotton country recently; many of these farmers had erected huge metal sheds which made us scratch our heads at the time. Why erect these huge sheds so far from your house to simply park a few old pick-ups beneath? It turns out that all these farmers had purchased brand new John Deere tractors, combines and many accessories. Some of them have easily spent one million plus on all of this.

The same commodity bull market that is fueling the likes of Potash Corporation (POT) of Saskatchewan, Mosaic (MOS) and Agrium (AGU) shares higher is also behind Deere & Company’s rise. As the world awakens to the fact that we need to increase food production in order to feed the growing population, productivity will become key. Many of the world’s breadbaskets already use the most advanced techniques, technologies and equipment, but much of the developing world continues to farm the same way generations before them did.

As China, India, Brazil, South Korea and the other emerging/developing economies of the world establish these large co-ops (at home and abroad) to grow crops for their citizens, Deere & Company should gain huge orders internationally.

Currently, analysts expect Deere to report earnings of $5.45/share for the current year. Estimates for 2012 call for earnings per share of $6.40. If the company can at least match these expectations, investors will have a blue chip stock providing significant upside in the share price because of near 20% profit growth.

Deere & Company possesses a great brand with competent management and a business model that should enable it to assist further generations of farmers in providing for the world. It is truly rare to find a company that can grow both the top and bottom line considerably year-over-year (enough to be considered a growth stock), consistently hike its dividend and provide international exposure to some of the hottest economies while being an American company and thus protecting investors from many of the inherent risks of investing with the unscrupulous managements of foreign entities that exist out there. The safety of an American based and traded company cannot be underestimated in these times; this lets many of our conservative investors sleep at night.

It is our opinion that Deere & Company is both a solid play for conservative investors and a derivative play on food inflation, both in the short-term and long-term. The company’s shares could potentially reach the $120/share range by year-end if the company can continue to perform well on an operating basis while also expanding the P/E. Should the commodity boom continue on the world’s farms, Deere’s shares could take off, potentially allowing shareholders to harvest tremendous gains.

Disclosure: I am long DE shares

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.

The company has been around since 1897, back when it was making plows for the family farm. Generations of farmers have used Deere & Company equipment to plow, plant and harvest their fields. John Deere is one of those brands and businesses that Warren Buffett would love as it has a cult following for its equipment in rural America and quality machinery to back the brand up. They have set the bar high, and the barrier to entry keeps many from entering their home market here in the United States.The stock currently trades just below its 52-week high of 89.97 and sports a price-to-earnings ratio of about 20 on a trailing twelve months basis. This is also a company currently paying a yearly dividend of $1.40 per share, or roughly a 1.6% yield. We expect that the company will raise the dividend twice this year based off of their operating results.

We believe that the company will be able to raise the dividend rates further this year due to strong earnings growth resulting from the bumper harvests these farmers are having in the United States. Here in South Carolina, we noticed fields of cotton not getting harvested on time and watched in amazement as the farmers allowed the crop to deteriorate. As it turns out, these were the farmers who pay others to harvest their crops, and thus do not own their own equipment; sometimes there are co-ops that perform this function as well. We did notice something very exciting driving through cotton country recently; many of these farmers had erected huge metal sheds which made us scratch our heads at the time. Why erect these huge sheds so far from your house to simply park a few old pick-ups beneath? It turns out that all these farmers had purchased brand new John Deere tractors, combines and many accessories. Some of them have easily spent one million plus on all of this.

The same commodity bull market that is fueling the likes of Potash Corporation (POT) of Saskatchewan, Mosaic (MOS) and Agrium (AGU) shares higher is also behind Deere & Company’s rise. As the world awakens to the fact that we need to increase food production in order to feed the growing population, productivity will become key. Many of the world’s breadbaskets already use the most advanced techniques, technologies and equipment, but much of the developing world continues to farm the same way generations before them did.

As China, India, Brazil, South Korea and the other emerging/developing economies of the world establish these large co-ops (at home and abroad) to grow crops for their citizens, Deere & Company should gain huge orders internationally.

Currently, analysts expect Deere to report earnings of $5.45/share for the current year. Estimates for 2012 call for earnings per share of $6.40. If the company can at least match these expectations, investors will have a blue chip stock providing significant upside in the share price because of near 20% profit growth.

Deere & Company possesses a great brand with competent management and a business model that should enable it to assist further generations of farmers in providing for the world. It is truly rare to find a company that can grow both the top and bottom line considerably year-over-year (enough to be considered a growth stock), consistently hike its dividend and provide international exposure to some of the hottest economies while being an American company and thus protecting investors from many of the inherent risks of investing with the unscrupulous managements of foreign entities that exist out there. The safety of an American based and traded company cannot be underestimated in these times; this lets many of our conservative investors sleep at night.

It is our opinion that Deere & Company is both a solid play for conservative investors and a derivative play on food inflation, both in the short-term and long-term. The company’s shares could potentially reach the $120/share range by year-end if the company can continue to perform well on an operating basis while also expanding the P/E. Should the commodity boom continue on the world’s farms, Deere’s shares could take off, potentially allowing shareholders to harvest tremendous gains.

Disclosure: I am long DE shares