Many beginning investors do not understand what a dividend is, as it relates to an investment, particularly an individual stock or mutual fund. A dividend is simply a payment to shareholders, typically of a publicly traded company. A dividend payment is a payout of portion of a company's profit to eligible stockholders.

However, not all companies pay a dividend. Usually, the board of directors determines if a dividend is desirable for their particular company based upon various financial and economic factors. Dividends are commonly paid in the form of cash distributions to the shareholders on a monthly, quarterly or yearly basis. Shareholders of any given stock must meet certain requirements before receiving a dividend payout, or distribution.

You must be a "shareholder of record" on or subsequent to a particular date designated by the company's board of directors in order to qualify for the dividend payout. Stocks are sometimes referred to as trading "ex-dividend", which simply means that they are trading on that particular day without dividend eligibility. If you buy and sell stock on its ex-dividend date, you will not receive the most current dividend payout. Now that you have a basic definition of what a dividend is and how it is distributed, let's focus in more detail on what more you need to understand before making your investment decision.

How Dividends Are Calculated

It may be counterintuitive, but as a stock's price increases, its dividend yield actually decreases. Many novice investors may incorrectly assume that a higher stock price correlates to a higher dividend yield. Let's delve into how dividend yield is calculated, so we can grasp this inverse relationship.

Dividends are normally paid on a per-share basis. If you own 100 shares of the ABC Corporation, the 100 shares is your basis for dividend distribution. Assume for the moment that ABC Corporation was purchased at $100/share, which implies a $10,000 total investment. Profits at the ABC Corporation were unusually high so the board of directors agrees to pay its shareholder $10 per share annually in the form of a cash dividend. So, as an owner of ABC Corporation for a year, your continued investment in ABC Corp should give us $1,000 in dividend dollars. The annual yield is the total dividend amount ($1,000) divided by the cost of the stock ($10,000) which gives us in percentage terms, 10%. If the 100 shares ABC Corporation was purchased at $200 per share, the yield would drop to 5%, since 100 shares now costs $20,000 OR your original $10,000 only gets you 50 shares, instead of 100. As illustrated above, if the price of the stock moves higher, then dividend yield drops and vice versa.

The Mechanics of Dividends

The real question one has to ask is whether dividend-paying stocks make a good overall investment. Dividends are derived from a company's profits, so it is fair to assume that in most cases, dividends are generally a sign of financial health. From an investment strategy perspective, buying established companies with a history of good dividends adds stability to a portfolio. Your $10,000 investment in ABC Corporation, if held for one year, will be worth $11,000, assuming the stock price after one year is unchanged. Moreover, if ABC Corporation is trading at $90 share a year after you purchased for $100 a share, your total investment after receiving dividends is still break even ($9,000 stock value + $1,000 in dividends).

This is the appeal to buying stocks with dividends: it helps cushion declines in the actual stock prices, but also presents an opportunity for stock price appreciation coupled with a steady stream of income that is dividends.

This is why many investing legends such as John Bogle, Warren Buffett and Benjamin Graham all espouse the virtues of buying stocks that pay a dividend as a critical part of the "investment" return of an asset. (Discover the issues that complicate these payouts for investors Dividend Facts You May Not Know.)

Risks to Dividends

During the financial meltdown in 2008-2009, all of the major banks either slashed or eliminated their dividend payouts. These companies were known for consistent, stable dividend payouts each quarter for literally hundreds of years. Despite their storied history, the dividend was cut.

In other words, dividends are not guaranteed, and are subject to macroeconomic as well as company-specific risks. Another potential downside to investing in dividend-paying stocks is that companies that pay dividends are not usually high growth leaders. There are few exceptions, but high-growth companies usually do not pay dividends to its shareholders even if they have significantly outperformed over the vast majority of all stocks over the last five years. Growth companies tend to spend more dollars on research and development, capital expansion, retaining talented employees and/or mergers and acquisitions.

For these companies, all earnings are considered retained earnings, and are reinvested back into the company instead of rewarding loyal shareholders. It is equally important to beware of companies with extraordinarily high yields.

As we have learned, if a company's stock price continues to decline, its yield goes up. Many rookie investors get teased into purchasing a stock just on the basis of a potential juicy dividend. There is no specific rule of thumb in relation to how much is too much in terms of a dividend payout.

The average dividend yield on the S&P500 companies that pay a dividend historically fluctuates somewhere between 2-5%, depending on market conditions. In general, it pays to do your homework on stocks yielding more than 8% to find out what is truly going on with the company. Doing this due diligence will help you decipher those companies that are truly in financial shambles from those that are temporarily out of favor and therefore present a good investment value proposition. (Explore arguments for and against company dividend policy, and learn how companies determine how much to pay out. Read How And Why Do Companies Pay Dividends?)

Conclusion

Dividends are really a discretionary distribution which a company's board of directors gives its current shareholders. It is typically a cash payout to investors at least once a year, but sometimes quarterly. Stocks and mutual funds that distribute dividends are likely on sound financial ground, but not always. Investors, however, should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable. Also, stocks that pay dividends typically provide stability to a portfolio, but do not usually outperform high quality growth stocks.

Disclosure None

Topics

Consumer-Goods

Basic-Materials

ETF'S

Services

Industrial-Goods

Black Gold(OIL)

Technology

Bonds

Links

Financial

Dividend-Increasers

Emerging Markets

Commodities

HealthCare

Inflation

IRA

Large Cap

Shipping

Utilities

Cefs

Small Caps

Fees

Monthly Dividend

Reits

Currency

8%+ Dividend

Food

Fixed Income

Agricultural

Precious metals

Dividend Declared

Insurance

Earnings Miss

Earnings Surprise

Silver

Insider Buying

MLP'S

Stock Splits

2 - 5% Dividend

Tips For NEW Investors

Banks

Global etfs

Aerospace

Computers

Index Funds

Preferred Stocks

New ETFS

Ultrashort Etfs

Asset Management

Chemicals

Hedged Etfs

5-8% Dividend

Bio-Tech

Build America Bonds

ETN'S

Investment Brokerage

Semiconductors

Steel

Bad Picks

Dividend Cut

Mortgage

Retail

Special Dividend

10+++% Dividend

2 - 5% dividend

Audio Podcasts

Bankruptcy

Diversified Investments

Dividend Axed

Equity Offering

Natural Gas

Office

Saturday, February 19, 2011

Slowdown In Emerging Markets Started Before Egypt

The iShares MSCI Emerging Markets ETF (EEM) dropped 3.2% to $45.33 a share today on more than three times its 90-day average volume.

But as technical analysts are pointing out Friday, signs of weakness in emerging markets stocks began appearing before riots in Egypt brought troops into the streets of Cairo.

Since reaching a multi-year high in November, shares of EEM have struggled to rebound. On Friday, the ETF’s price closed near its intra-day low. In a sense, like a punch-drunk boxer, EEM was saved by the bell.

From a technical standpoint, EEM’s next level of support is around $44.78 a share, its low point at the end of November. Below that level, a fall to roughly $43 a share would leave EEM close to its 200-day moving average, a key line of defense that technicians monitor.

At the end of 2010, China represented about 17% of EEM’s assets, its largest single country. With belt tightening and possible interest rate hikes on the horizon, stocks in China could face more downward pressure.

The portfolio’s second-biggest country is Brazil at nearly 16%. It faces some rather severe inflationary pressures as well.

Throw in recent unrest in Indonesia, Tunisia and, now Egypt. It doesn’t paint a pretty picture right now for EEM investors.

At least one money manager I’ve followed over the years pulled the trigger today.

As he was working on his latest weekly newsletter for clients this afternoon, Jerry Slusiewicz, the president of Pacific Financial Planners in Laguna Hills, Calif., took a few minutes to explain why he’d shifted a small portion of his client assets into the ProShares UltraShort MSCI Emerging Markets ETF (EEV).

“There’s been rioting for a few days now in Egypt. The big question is whether unrest continues and if it’ll spread to more countries,” he said.

Slusiewicz noted that he’d moved out of EEM last week and early this morning shifted a small, partial position in his global portfolio into the leveraged ProShares ETF.

EEV closed up 6.3%, or $2.06, at $34.71 a share. Volume on the day was up 272% in the ETF. Slusiewicz set a stop/loss at $32.15, a nickle below Thursday’s close.

“There’s no reason to play around here — this trade is either going to work or it won’t,” he said. “It’s just a play on growing weakness in emerging markets over the past few months. But I’m bullish on their prospects over the longer-term.”

His price target on EEV is $37 a share, which was near where the ETF peaked in November.

“Hopefully, this (unrest in Egypt) will be over shortly. I’m not taking the mindset that the world’s about to catch on fire or anything. But technically, emerging markets look a little weak right now,” Slusiewicz said.

Disclosure None

But as technical analysts are pointing out Friday, signs of weakness in emerging markets stocks began appearing before riots in Egypt brought troops into the streets of Cairo.

Since reaching a multi-year high in November, shares of EEM have struggled to rebound. On Friday, the ETF’s price closed near its intra-day low. In a sense, like a punch-drunk boxer, EEM was saved by the bell.

From a technical standpoint, EEM’s next level of support is around $44.78 a share, its low point at the end of November. Below that level, a fall to roughly $43 a share would leave EEM close to its 200-day moving average, a key line of defense that technicians monitor.

At the end of 2010, China represented about 17% of EEM’s assets, its largest single country. With belt tightening and possible interest rate hikes on the horizon, stocks in China could face more downward pressure.

The portfolio’s second-biggest country is Brazil at nearly 16%. It faces some rather severe inflationary pressures as well.

Throw in recent unrest in Indonesia, Tunisia and, now Egypt. It doesn’t paint a pretty picture right now for EEM investors.

At least one money manager I’ve followed over the years pulled the trigger today.

As he was working on his latest weekly newsletter for clients this afternoon, Jerry Slusiewicz, the president of Pacific Financial Planners in Laguna Hills, Calif., took a few minutes to explain why he’d shifted a small portion of his client assets into the ProShares UltraShort MSCI Emerging Markets ETF (EEV).

“There’s been rioting for a few days now in Egypt. The big question is whether unrest continues and if it’ll spread to more countries,” he said.

Slusiewicz noted that he’d moved out of EEM last week and early this morning shifted a small, partial position in his global portfolio into the leveraged ProShares ETF.

EEV closed up 6.3%, or $2.06, at $34.71 a share. Volume on the day was up 272% in the ETF. Slusiewicz set a stop/loss at $32.15, a nickle below Thursday’s close.

“There’s no reason to play around here — this trade is either going to work or it won’t,” he said. “It’s just a play on growing weakness in emerging markets over the past few months. But I’m bullish on their prospects over the longer-term.”

His price target on EEV is $37 a share, which was near where the ETF peaked in November.

“Hopefully, this (unrest in Egypt) will be over shortly. I’m not taking the mindset that the world’s about to catch on fire or anything. But technically, emerging markets look a little weak right now,” Slusiewicz said.

Disclosure None

ETF Shorting Bonds Up 11% This Year; Treasury Yields Slipping Today

With bond yields rising, returns of the iShares Barclays 20+ Year Treasury Bond ETF (TLT) have dropped nearly 5.7% so far in 2011.

By contrast, the ProShares UltraShort 20+ Year Treasury ETF (TBT) has gained more than 11.3% entering today’s session, according to Morningstar data.

TLT’s shares are on a slight rebound in the early going, up by 0.2% as yields slip ahead of government auctions of 10-year notes and traders start to digest word of Fed Chair Ben Bernanke’s statements before Congress this morning.

Disclosure I am Long TLT shares.

By contrast, the ProShares UltraShort 20+ Year Treasury ETF (TBT) has gained more than 11.3% entering today’s session, according to Morningstar data.

TLT’s shares are on a slight rebound in the early going, up by 0.2% as yields slip ahead of government auctions of 10-year notes and traders start to digest word of Fed Chair Ben Bernanke’s statements before Congress this morning.

Disclosure I am Long TLT shares.

RF Industries (RFIL) Announces Two-for-One Split; Increases Quarterly Dividend 33%

RF Industries, Ltd., (Nasdaq: RFIL) announced that their Board has declared a two-for-one split.

The Board also declared a quarterly dividend of $0.02 per common share post-split, $0.08 annualized. The dividend is a 33% increase from the current rate, following the split.

The dividend is payable on April 15, 2011, to shareholders of record on March 31, 2011. The ex-dividend date is March 29, 2011.

Yield on the dividend, currently, is 1%.

Disclosure None

The Board also declared a quarterly dividend of $0.02 per common share post-split, $0.08 annualized. The dividend is a 33% increase from the current rate, following the split.

The dividend is payable on April 15, 2011, to shareholders of record on March 31, 2011. The ex-dividend date is March 29, 2011.

Yield on the dividend, currently, is 1%.

Disclosure None

United Security Bancshares (USBI) Slashes Quarterly Cash Dividend

United Security Bancshares, Inc. (Nasdaq: USBI) announced a quarterly cash dividend of $0.04 per share. The dividend is payable April 1, 2011, to shareholders of record on March 11, 2011. The dividend was reduced from $0.11 per share paid in the most recent quarter.

R. Terry Phillips, President and CEO, said "Over the past year, our earnings have been below historical levels due to the negative impact associated with non-performing loans, foreclosed properties and provision for loan losses, all of which were primarily caused by a continued weak economy and steadily declining real estate values. Our Board believes the reduction in the cash dividend reflects our plans to protect our capital from further adverse effects resulting from the current economic environment.”

Disclosure None

R. Terry Phillips, President and CEO, said "Over the past year, our earnings have been below historical levels due to the negative impact associated with non-performing loans, foreclosed properties and provision for loan losses, all of which were primarily caused by a continued weak economy and steadily declining real estate values. Our Board believes the reduction in the cash dividend reflects our plans to protect our capital from further adverse effects resulting from the current economic environment.”

Disclosure None

U.S. ETFs Leave Emerging Markets in the Dust

As emerging markets grapple with increasing economic and social problems, U.S.-focused exchange traded funds (ETFs) are seizing their moment to charge ahead.

Aside from slowly but surely improving economic numbers, there are other indications that the U.S. economy is getting on stronger footing:

* Economists see China’s decreasing trade surplus as indicative of growing middle class that may be starting to shift from saving toward greater purchases of imported goods from the U.S. and other foreign countries, reports Douglas A. McIntyre for The Atlantic. U.S. exports suffered in the recession, so a turnaround on this front is welcome.

* Meanwhile, the Wall Street Journal recently polled 51 economists about the U.S. GDP projections and reported that the economists “expect gross domestic product will be 3.5% higher in the fourth quarter of 2011 than a year earlier, up from the 3.3% increase they projected in last month’s survey. That would be the largest increase since 2003.”

* Rising consumer and business confidence, along with tax cuts and small gains in employment, could also push the economy into faster growth.

* Federal Reserve Chairman Ben Bernanke recently noted increasing “evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” writes Kevin G. Hall for Miami Herald. “The recent gains in consumer

spending look to have been reasonably broad-based,” adds Bernanke.

There are still some real risks, however: unemployment is high, the real estate market continues to find its footing, inflation is a threat and consumers still aren’t spending at the levels some would like to see.

While there are a number of ways to play a U.S. economic recovery, you can’t deny the classics:

* SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA): The Dow Jones Industrial Average recently closed above 12,000 for the first time since 2008. Though the Dow (and DIA) only own 30 stocks, making it debatable as to how representative it is, it’s still one of the most closely-watched indexes in the world.

* SPDR S&P 500 ETF (NYSEArca: SPY): The S&P 500 and SPY track the 500 largest stocks in the country. It’s considered the best barometer of how the United States economy is doing.

* PowerShares QQQ Trust (NASDAQ: QQQQ): The NASDAQ is known for its large allocation to the technology sector. It also happens to be the top-performing index year-to-date, up nearly 17%.

Disclosure I am Long DIA and SPY shares.

Aside from slowly but surely improving economic numbers, there are other indications that the U.S. economy is getting on stronger footing:

* Economists see China’s decreasing trade surplus as indicative of growing middle class that may be starting to shift from saving toward greater purchases of imported goods from the U.S. and other foreign countries, reports Douglas A. McIntyre for The Atlantic. U.S. exports suffered in the recession, so a turnaround on this front is welcome.

* Meanwhile, the Wall Street Journal recently polled 51 economists about the U.S. GDP projections and reported that the economists “expect gross domestic product will be 3.5% higher in the fourth quarter of 2011 than a year earlier, up from the 3.3% increase they projected in last month’s survey. That would be the largest increase since 2003.”

* Rising consumer and business confidence, along with tax cuts and small gains in employment, could also push the economy into faster growth.

* Federal Reserve Chairman Ben Bernanke recently noted increasing “evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” writes Kevin G. Hall for Miami Herald. “The recent gains in consumer

spending look to have been reasonably broad-based,” adds Bernanke.

There are still some real risks, however: unemployment is high, the real estate market continues to find its footing, inflation is a threat and consumers still aren’t spending at the levels some would like to see.

While there are a number of ways to play a U.S. economic recovery, you can’t deny the classics:

* SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA): The Dow Jones Industrial Average recently closed above 12,000 for the first time since 2008. Though the Dow (and DIA) only own 30 stocks, making it debatable as to how representative it is, it’s still one of the most closely-watched indexes in the world.

* SPDR S&P 500 ETF (NYSEArca: SPY): The S&P 500 and SPY track the 500 largest stocks in the country. It’s considered the best barometer of how the United States economy is doing.

* PowerShares QQQ Trust (NASDAQ: QQQQ): The NASDAQ is known for its large allocation to the technology sector. It also happens to be the top-performing index year-to-date, up nearly 17%.

Disclosure I am Long DIA and SPY shares.

Sara Lee (SLE) to Split into Two Public Entities; Sees $3/Share Special Dividend, Offers FY11 Guidance

Sara Lee Corp. (NYSE: SLE) announced that its Board has agreed in principle to divide the company into two separate, publicly traded companies. The separation is expected to be completed in early calendar year 2012.

Under the plan approved, Sara Lee’s North American Retail and North American Foodservice units (excluding the North American beverage business) will be spun off, tax-free, into a new public company that will retain the “Sara Lee” name. Its brands will include Sara Lee, Jimmy Dean, Ball Park, Hillshire Farm, Chef Pierre and State Fair.

The yet to be named other company will consist of Sara Lee’s current International Beverage and Bakery businesses, as well as the North American beverage business. Its leading brands will include Douwe Egberts, Senseo, Pickwick, Maison du Café, L’OR, Café Pilão, Marcilla and Bimbo.

In conjunction with today's news, Sara Lee's Board has said it intends to declare a $3/share special dividend on common stock, the majority of which will be funded with proceeds from the sale of the company’s North American Fresh Bakery business. The special dividend is expected to be declared and paid in fiscal 2012 and before completion of the spin-off of Sara Lee’s North American Retail and North American Foodservice businesses.

Sees FY11 EPS from continuing operations of 82-86c, with sales of $11.9-$12.1 billion and cash flow from operations of about $400-$500 million.

Disclosure NONE and no plans in the future.

Under the plan approved, Sara Lee’s North American Retail and North American Foodservice units (excluding the North American beverage business) will be spun off, tax-free, into a new public company that will retain the “Sara Lee” name. Its brands will include Sara Lee, Jimmy Dean, Ball Park, Hillshire Farm, Chef Pierre and State Fair.

The yet to be named other company will consist of Sara Lee’s current International Beverage and Bakery businesses, as well as the North American beverage business. Its leading brands will include Douwe Egberts, Senseo, Pickwick, Maison du Café, L’OR, Café Pilão, Marcilla and Bimbo.

In conjunction with today's news, Sara Lee's Board has said it intends to declare a $3/share special dividend on common stock, the majority of which will be funded with proceeds from the sale of the company’s North American Fresh Bakery business. The special dividend is expected to be declared and paid in fiscal 2012 and before completion of the spin-off of Sara Lee’s North American Retail and North American Foodservice businesses.

Sees FY11 EPS from continuing operations of 82-86c, with sales of $11.9-$12.1 billion and cash flow from operations of about $400-$500 million.

Disclosure NONE and no plans in the future.

TCAP stock sale raises $63M Triangle Capital Corporation

Underwriters conducting a share offering for Raleigh-based Triangle Capital Corp. (NYSE:TCAP) sold over-allotments in the face of investor interest, upping the company’s take in the deal by 15 percent to $63 million.

In all, 3.45 million shares, including the over-allotments, were offered at $19.25 a share.

In a statement on the results, specialty business lender TCAP says it plans to use the proceeds to invest in lower middle market companies and for general corporate purposes.

Underwriters of this offering were Morgan Keegan Robert W. Baird, BB&T Capital Janney Montgomery Scott LLC, and JMP Securities LLC.

Triangle Capital Corporation is a private equity and venture capital firm specializing in buyouts, change of control transactions, acquisitions, growth financing, and recapitalizations in lower middle market companies. The firm prefers to make investments in many business sectors including manufacturing, distribution, transportation, energy, communications, health services, restaurants, and others. It primarily invests in companies located throughout the United States, with an emphasis on the Southeast.

The firm typically invests between $5 million and $15 million per transaction, in companies having annual revenues between $20 million and $100 million and EBITDA between $3 million and $20 million and can also co-invest. It primarily invests in senior subordinated debt securities secured by second lien security interests in portfolio company assets, coupled with equity interests. Triangle Capital Corporation was founded in 2002 and is based in Raleigh, North Carolina.

Disclosure I am Long TCAP shares.

In all, 3.45 million shares, including the over-allotments, were offered at $19.25 a share.

In a statement on the results, specialty business lender TCAP says it plans to use the proceeds to invest in lower middle market companies and for general corporate purposes.

Underwriters of this offering were Morgan Keegan Robert W. Baird, BB&T Capital Janney Montgomery Scott LLC, and JMP Securities LLC.

Triangle Capital Corporation is a private equity and venture capital firm specializing in buyouts, change of control transactions, acquisitions, growth financing, and recapitalizations in lower middle market companies. The firm prefers to make investments in many business sectors including manufacturing, distribution, transportation, energy, communications, health services, restaurants, and others. It primarily invests in companies located throughout the United States, with an emphasis on the Southeast.

The firm typically invests between $5 million and $15 million per transaction, in companies having annual revenues between $20 million and $100 million and EBITDA between $3 million and $20 million and can also co-invest. It primarily invests in senior subordinated debt securities secured by second lien security interests in portfolio company assets, coupled with equity interests. Triangle Capital Corporation was founded in 2002 and is based in Raleigh, North Carolina.

Disclosure I am Long TCAP shares.

GeoResources, Prospect Capital to join S&P index (PSEC)

GeoResources Inc. and Prospect Capital Corp.(PSEC) will be added to the S&P SmallCap 600 index, according to Standard & Poor's, sending shares of both companies higher Tuesday.

S&P announced the planned index changes following Monday's close of trading. Stocks that are about to be added to indexes typically rally, because it's expected that mutual funds and other investment vehicles that track the indexes will buy shares.

GeoResources, a Houston-based developer and explorer of oil and gas reserves, will be added to the S&P SmallCap 600 after the close of trading on Wednesday. It will replace Seahawk Drilling Inc., which filed for bankruptcy protection, and is no longer eligible for inclusion in the index, S&P said.

Shares of GeoResources rose $1.07, or about 3.8 percent, to $29.29 in afternoon trading, after reaching a 52-week high of $29.94 earlier.

Prospect Capital, a New York-based lender and investor in privately held middle-market companies, will be added to the index after Friday's close of trading. It will replace Martek Biosciences Corp., which is being acquired by Royal DSM N.V. in a deal expected to be completed soon.

Shares of Prospect Capital rose 18 cents, or about 1.5 percent, to $11.78.

In addition to joining the SmallCap 600, GeoResources will be added to the index's Oil & Gas Exploration and Production Sub-Industry index. Prospect Capital will be part of the Asset Management & Custody Banks Sub-Industry index.

Disclosure I am Long PSEC shares.

S&P announced the planned index changes following Monday's close of trading. Stocks that are about to be added to indexes typically rally, because it's expected that mutual funds and other investment vehicles that track the indexes will buy shares.

GeoResources, a Houston-based developer and explorer of oil and gas reserves, will be added to the S&P SmallCap 600 after the close of trading on Wednesday. It will replace Seahawk Drilling Inc., which filed for bankruptcy protection, and is no longer eligible for inclusion in the index, S&P said.

Shares of GeoResources rose $1.07, or about 3.8 percent, to $29.29 in afternoon trading, after reaching a 52-week high of $29.94 earlier.

Prospect Capital, a New York-based lender and investor in privately held middle-market companies, will be added to the index after Friday's close of trading. It will replace Martek Biosciences Corp., which is being acquired by Royal DSM N.V. in a deal expected to be completed soon.

Shares of Prospect Capital rose 18 cents, or about 1.5 percent, to $11.78.

In addition to joining the SmallCap 600, GeoResources will be added to the index's Oil & Gas Exploration and Production Sub-Industry index. Prospect Capital will be part of the Asset Management & Custody Banks Sub-Industry index.

Disclosure I am Long PSEC shares.

Questar approved a 9% increase in the quarterly common-stock dividend to $0.1525 (STR)

Questar (NYSE: STR) raises its quarterly dividend by 8.9% from 14c to 15.25c per common share.

The dividend is payable on March 21 to shareholders of record on March 4. The ex-dividend date is March 2.

The dividend yield moves from 3.11% to 3.39%.

Questar Corporation, a natural gas-focused energy company, through its subsidiaries, engages in the gas and oil exploration and production, midstream field services, energy marketing, interstate gas transportation, and retail gas distribution businesses. It acquires, explores for, develops, and produces natural gas, oil, and natural gas liquids in the Rocky Mountain region of Wyoming, Utah, Colorado, and North Dakota, as well as the Midcontinent region of Oklahoma, Texas, and Louisiana; and manages, develops, and produces reserves for gas utility and sells crude-oil production from certain oil-producing properties. The company also provides midstream field services, including natural gas-gathering and processing for affiliates and third parties; markets equity and third-party natural gas, oil, and natural gas liquids to refiners, remarketers, and other companies; provides risk-management services; and owns and operates an underground gas-storage reservoir.

In addition, it offers interstate natural gas transportation and underground storage services; gas-processing services for third parties; interstate natural gas transportation and storage, and other energy services; and retail natural gas distribution services. As of December 31, 2009, it had estimated proved reserves of 2,746.9 Bcfe; served 898,558 sales and transportation customers; owned 2,568 miles of interstate pipeline with total firm capacity commitments of 4,243 Mdth per day; and owned and operated the 488-mile Southern Trails Pipeline from the Blanco hub in the San Juan Basin to the California state line. Questar Corporation was founded in 1922 and is headquartered in Salt Lake City, Utah.

Disclosure I am Long STR shares.

The dividend is payable on March 21 to shareholders of record on March 4. The ex-dividend date is March 2.

The dividend yield moves from 3.11% to 3.39%.

Questar Corporation, a natural gas-focused energy company, through its subsidiaries, engages in the gas and oil exploration and production, midstream field services, energy marketing, interstate gas transportation, and retail gas distribution businesses. It acquires, explores for, develops, and produces natural gas, oil, and natural gas liquids in the Rocky Mountain region of Wyoming, Utah, Colorado, and North Dakota, as well as the Midcontinent region of Oklahoma, Texas, and Louisiana; and manages, develops, and produces reserves for gas utility and sells crude-oil production from certain oil-producing properties. The company also provides midstream field services, including natural gas-gathering and processing for affiliates and third parties; markets equity and third-party natural gas, oil, and natural gas liquids to refiners, remarketers, and other companies; provides risk-management services; and owns and operates an underground gas-storage reservoir.

In addition, it offers interstate natural gas transportation and underground storage services; gas-processing services for third parties; interstate natural gas transportation and storage, and other energy services; and retail natural gas distribution services. As of December 31, 2009, it had estimated proved reserves of 2,746.9 Bcfe; served 898,558 sales and transportation customers; owned 2,568 miles of interstate pipeline with total firm capacity commitments of 4,243 Mdth per day; and owned and operated the 488-mile Southern Trails Pipeline from the Blanco hub in the San Juan Basin to the California state line. Questar Corporation was founded in 1922 and is headquartered in Salt Lake City, Utah.

Disclosure I am Long STR shares.

Caterpillar January Sales Jump 49%, CAT Profit Soars on Farm Machinery Purchases

Deere & Company DE-Quote, the world’s largest maker of agricultural equipment, said on Wednesday that its quarterly net income had more than doubled as rising crop prices encouraged farmers to buy new machinery and increase planting.

Deere’s sales increase was driven by demand for heavy farm equipment, with revenue for four-wheel-drive tractors and large combines rising more than 50 percent.

Deere is expanding overseas operations, but its sales are rooted in North America, with United States and Canadian sales rising 35 percent in the quarter. Outside those core regions, sales rose 22 percent in the quarter.

The company said it earned $513.7 million, or $1.20 a share, in the quarter, up from $243.2 million, or 57 cents a share, a year earlier. Revenue in the period, which ended Jan. 31 and was the first quarter of Deere’s fiscal year, rose 27 percent, to $6.12 billion, from $4.83 billion.

Stock in Deere, which is based in Moline, Ill., rose $2.24, to $95.86 a share.

Deere said construction demand was up as well. Construction and forestry sales climbed 81 percent, and the unit turned an operating profit in the quarter after losing money a year earlier. Deere predicts net income this fiscal year of about $2.5 billion, up from a November prediction of $2.1 billion. Analysts currently predict $2.37 billion.

Disclosure I am Long DE shares.

The company also raised its earnings prediction for the year.

Deere’s sales increase was driven by demand for heavy farm equipment, with revenue for four-wheel-drive tractors and large combines rising more than 50 percent.

Deere is expanding overseas operations, but its sales are rooted in North America, with United States and Canadian sales rising 35 percent in the quarter. Outside those core regions, sales rose 22 percent in the quarter.

The company said it earned $513.7 million, or $1.20 a share, in the quarter, up from $243.2 million, or 57 cents a share, a year earlier. Revenue in the period, which ended Jan. 31 and was the first quarter of Deere’s fiscal year, rose 27 percent, to $6.12 billion, from $4.83 billion.

Stock in Deere, which is based in Moline, Ill., rose $2.24, to $95.86 a share.

Deere said construction demand was up as well. Construction and forestry sales climbed 81 percent, and the unit turned an operating profit in the quarter after losing money a year earlier. Deere predicts net income this fiscal year of about $2.5 billion, up from a November prediction of $2.1 billion. Analysts currently predict $2.37 billion.

Disclosure I am Long DE shares.

Industrials ETFs Continue Impressive Rally my Fav RGI Small cap exposure

During the ongoing recovery effort, most sectors of the global economy have moved higher together. But not all industries have received an equal boost during the dramatic turnaround. After markets bottomed out in March 2009, it was the financial and technology sectors that led the rally. In 2010, one of the least sexy sectors had sprinted to the front of the pack: industrials. Boosted by signs of life in the manufacturing sector, surprising strength from homebuilders, and, most recently, impressive earnings figures, industrials ETFs are among the top performing funds in 2010.

The Industrials Select Sector SPDR (XLI) was recently up 15% on the year, putting it about 750 basis points ahead of the S&P 500 SPDR (SPY). The Utilities SPDR (XLU) is down almost 4% so far on the year, putting it nearly 20% behind the Industrials SPDR.

The industrial sector is one of the most assorted corners of the U.S. economy, including aerospace & defense stocks, railroads, electrical equipment, construction and engineering, airlines, and good old-fashioned conglomerates. So putting a finger on the exact source of the rally is a bit challenging; rather, there are a number of factors contributing to the big run-up in the industrial sector this year. After making significant cost cuts during the downturn, profit margins have spiked following even moderate increases in revenue. Demand for products from emerging markets has surged, with the BRIC economies snapping up everything from small machinery to airplanes. Moreover, early cycle markets in the U.S. are rallying as consumer spending picks up once again.

As business activity has picked up, several industrial sub-sectors have received a nice boost. Many homebuilders have bounced back from the brink of collapse, while a resurgence in the airline industry (prior to the recent shutdown following Iceland’s volcanic eruption at least) has given a boost to stocks battered during the downturn. Dozens of industrial companies have reported impressive earnings and lifted full year outlooks in recent weeks, citing strong global demand for their products as the primary drivers.

The Industrials Select Sector SPDR (XLI) was recently up 15% on the year, putting it about 750 basis points ahead of the S&P 500 SPDR (SPY). The Utilities SPDR (XLU) is down almost 4% so far on the year, putting it nearly 20% behind the Industrials SPDR.

The industrial sector is one of the most assorted corners of the U.S. economy, including aerospace & defense stocks, railroads, electrical equipment, construction and engineering, airlines, and good old-fashioned conglomerates. So putting a finger on the exact source of the rally is a bit challenging; rather, there are a number of factors contributing to the big run-up in the industrial sector this year. After making significant cost cuts during the downturn, profit margins have spiked following even moderate increases in revenue. Demand for products from emerging markets has surged, with the BRIC economies snapping up everything from small machinery to airplanes. Moreover, early cycle markets in the U.S. are rallying as consumer spending picks up once again.

As business activity has picked up, several industrial sub-sectors have received a nice boost. Many homebuilders have bounced back from the brink of collapse, while a resurgence in the airline industry (prior to the recent shutdown following Iceland’s volcanic eruption at least) has given a boost to stocks battered during the downturn. Dozens of industrial companies have reported impressive earnings and lifted full year outlooks in recent weeks, citing strong global demand for their products as the primary drivers.

Industrials ETFs In Focus

For investors expecting the industrials rally to continue, there are a number of ETF options that offer exposure to this sector (see all ETFs in the Industrials Equities ETFdb Category).- Industrials Select Sector SPDR (XLI): This ETF is one of the largest industrials ETFs, tracking the performance of the Industrials Select Sector Index. A look at the largest components illustrates the diversity of the companies included in the industrials sector; big holdings include General Electric, UPS, 3M, Union Pacific, Caterpillar, and Boeing. XLI is up about 16% already on the year and charges an expense ratio 0f 0.21%.

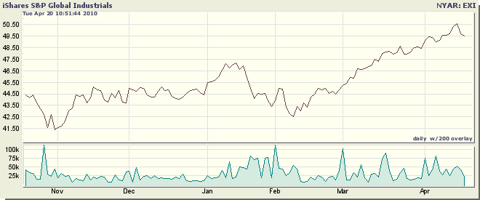

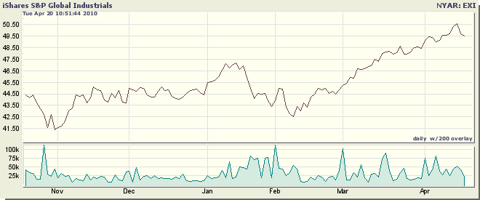

- iShares S&P Global Industrials (EXI): For investors looking to achieve global exposure to the industrial sector, EXI is an interesting option. U.S. equities account for just under 50% of holdings, with Japan, France, and Germany representing the largest international allocations. EXI has about 180 components and charges 0.48%.

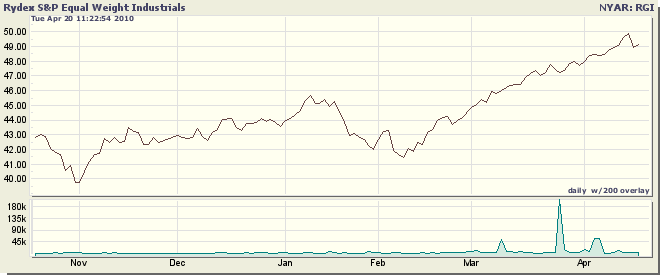

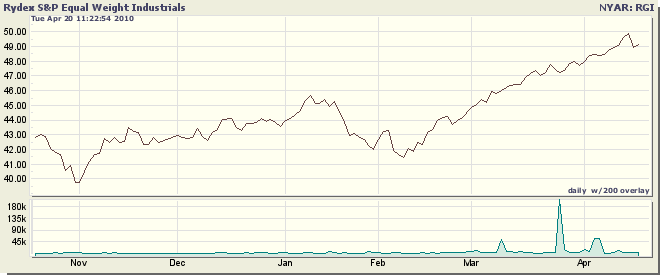

- Rydex S&P Equal Weight Industrials (RGI): This ETF presents a twist on traditional cap-weighted ETFs, giving each industrial company in the S&P 500 an equal weighting. So RGI gives the same weighting to General Electric as it does to Cintas, a potentially attractive feature for investors who believe cap-weighting strategies are inherently flawed.

Other Options

Other ETFs offering exposure to the industrial sector include:- Global X China Industrials ETF (CHII): Targets the industrial sector of the Chinese economy.

- PowerShares S&P SmallCap Industrials Portfolio (XLIS): Consists of industrials companies included in the S&P SmallCap 600.

- iShares Dow Jones U.S. Aerospace & Defense Index Fund (ITA): Offers exposure to defense companies and manufacturers of aircraft and aircraft parts.

VANGUARD FINANCIALS ETF: 52-WEEK HIGH RECENTLY ECLIPSED (VFH)

Shares of Vanguard Financials ETF (NYSE:VFH) traded at a new 52-week high, Tuesday the 15th of Feb., of $35.11. Approximately 63,000 shares have traded hands today vs. average 30-day volume of 217,000 shares.

Vanguard Financials ETF is currently trading at $35.08, approximately 5.3% above its 50-day moving average of $33.30. SmarTrend will be monitoring shares of VFH to see if this bullish momentum will continue.

In the last five trading sessions, the 50-day MA has climbed 0.78% while the 200-day MA has remained constant.

In the past 52 weeks, shares of Vanguard Financials ETF have traded between a low of $13.02 and a high of $35.07 and are now at $35.08, which is 169% above that low price.

The investment seeks to track the performance of a benchmark index that measures the investment return of financial stocks. The fund employs a passive management investment approach designed to track the performance of the MSCI U.S. Investable Market Financials 25/50 index. This index consists of stocks of U.S. companies within the financial sector. This sector is made up of companies involved in activities such as banking, mortgage finance, consumer finance, specialized finance, investment banking and brokerage, asset management and custody, corporate lending, insurance, financial investment, and real estate. It is non-diversified.

Disclosure I am Long VFH shares.

Vanguard Financials ETF is currently trading at $35.08, approximately 5.3% above its 50-day moving average of $33.30. SmarTrend will be monitoring shares of VFH to see if this bullish momentum will continue.

In the last five trading sessions, the 50-day MA has climbed 0.78% while the 200-day MA has remained constant.

In the past 52 weeks, shares of Vanguard Financials ETF have traded between a low of $13.02 and a high of $35.07 and are now at $35.08, which is 169% above that low price.

The investment seeks to track the performance of a benchmark index that measures the investment return of financial stocks. The fund employs a passive management investment approach designed to track the performance of the MSCI U.S. Investable Market Financials 25/50 index. This index consists of stocks of U.S. companies within the financial sector. This sector is made up of companies involved in activities such as banking, mortgage finance, consumer finance, specialized finance, investment banking and brokerage, asset management and custody, corporate lending, insurance, financial investment, and real estate. It is non-diversified.

Disclosure I am Long VFH shares.

I like Apple Do you like Apple? But I LOVE Apple with a 8.32% Yield!~!(NASDAQ: QQQX)

NASDAQ Premium Income & Growth Fund (NASDAQ: QQQX), Introducing a shot at playing apple shares and yet still get paid a handsome 8.32% dividend each and every quarter. Top holding is apple at 20.5%, top holdings below:

First, the Fund will invest substantially all of its net assets in a portfolio of investments designed to closely track the performance of the NASDAQ 100 Index.

Second, the Fund will use certain option strategies primarily consisting of writing NASDAQ 100 Index call options to generate premium income and reduce the volatility of the Fund's returns, with the intention of improving the Fund's risk adjusted returns.

The Fund invests in industries, such as software, computers and peripherals, communications equipment, semiconductors and semiconductor equipment, and biotechnology. IQ Investment Advisors LLC serves as the investment advisor to the Fund. The Fund's sub-advisor is Nuveen HydePark Group, LLC.

Disclosure I am Long QQQX shares.

| Issuer | % Portfolio |

|---|---|

| Apple Computer Inco: Equity | 20.59% |

| Qualcomm: Equity | 5.06% |

| Google Inc: Equity | 4.53% |

| Microsoft Corporati: Equity | 4.13% |

| Oracle Corporation: Equity | 3.65% |

| Intel Corporation: Equity | 2.85% |

| Amazon.com Incorpor: Equity | 2.74% |

| Gilead Sciences Inc: Equity | 2.25% |

| Comcast Corporation: Equity | 2.20% |

| Cisco Systems Incor: Equity | 2.07% |

OBJECTIVE

The Fund seeks high current income and capital appreciation through investment in a portfolio of investments designed to closely track the performance of the NASDAQ 100 Index and by writing NASDAQ 100 Index call option.

NASDAQ Premium Income & Growth Fund Inc. (the Fund) is a diversified, closed-end management investment company. The Fund's investment objective is to provide premium income and capital appreciation. The Fund pursues its objective principally through a two-part strategy.First, the Fund will invest substantially all of its net assets in a portfolio of investments designed to closely track the performance of the NASDAQ 100 Index.

Second, the Fund will use certain option strategies primarily consisting of writing NASDAQ 100 Index call options to generate premium income and reduce the volatility of the Fund's returns, with the intention of improving the Fund's risk adjusted returns.

The Fund invests in industries, such as software, computers and peripherals, communications equipment, semiconductors and semiconductor equipment, and biotechnology. IQ Investment Advisors LLC serves as the investment advisor to the Fund. The Fund's sub-advisor is Nuveen HydePark Group, LLC.

Disclosure I am Long QQQX shares.

Claymore’s New ‘SEA’ ETF Sets Sail

Claymore Securities, the Lisle, Ill.-based money management firm known for its niche investment strategies, relaunched its shipping industry ETF “SEA” after being forced to close a previous version of the fund in April.

In an ETF-industry first, Claymore was forced to shut down SEA after a shareholder vote related to Claymore’s acquisition by Guggenheim Partners in October didn’t attract enough voters to establish a quorum. The vote was required to approve a change in the fund’s investment advisers. Claymore said at the time that it planned to open a new shipping fund as soon as possible, hopefully with the same ticker.

Claymore has made good on that pledge. The Claymore Shipping ETF fund is listed on the New York Stock Exchange, with the same ticker (NYSEArca: SEA) and with the same expense ratio of 0.65 percent. The original SEA, launched in August 2007, had gathered almost $153 million by the time it closed.

Claymore Managing Director William Belden has said that the situation was extraordinary, particularly in view of the fact that none of Claymore’s other funds that had to conduct the same get-out-the-vote drive failed to obtain the required 50 percent quorum.

Belden added that the fact that many investors used SEA as part of short-term, sector rotation strategies meant that some shareholders no longer owned the fund by the time Claymore solicited their votes. Many held their SEA shares anonymously, making the vote-gathering challenge more significant, he said.

Disclosure I am Long SEA shares.

In an ETF-industry first, Claymore was forced to shut down SEA after a shareholder vote related to Claymore’s acquisition by Guggenheim Partners in October didn’t attract enough voters to establish a quorum. The vote was required to approve a change in the fund’s investment advisers. Claymore said at the time that it planned to open a new shipping fund as soon as possible, hopefully with the same ticker.

Claymore has made good on that pledge. The Claymore Shipping ETF fund is listed on the New York Stock Exchange, with the same ticker (NYSEArca: SEA) and with the same expense ratio of 0.65 percent. The original SEA, launched in August 2007, had gathered almost $153 million by the time it closed.

Claymore Managing Director William Belden has said that the situation was extraordinary, particularly in view of the fact that none of Claymore’s other funds that had to conduct the same get-out-the-vote drive failed to obtain the required 50 percent quorum.

Belden added that the fact that many investors used SEA as part of short-term, sector rotation strategies meant that some shareholders no longer owned the fund by the time Claymore solicited their votes. Many held their SEA shares anonymously, making the vote-gathering challenge more significant, he said.

Disclosure I am Long SEA shares.

H&Q Healthcare Investors Declares Stock Distribution

On February 7, 2011, H&Q Healthcare Investors declared a stock distribution of $0.31 per share. The record date for the stock distribution is February 21, 2011 and the payable date is March 31, 2011. The Fund will trade ex-distribution on February 17, 2011.

This stock distribution will automatically be paid in newly issued shares of the Fund unless otherwise instructed by the shareholder. The shares will be valued at the lower of the net asset value or market price on the pricing date, March 24, 2011. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts at the transfer agent who will have whole and fractional shares added to their account.

Shareholders may request to be paid in cash instead of shares by responding to the bank, brokerage or nominee who holds the shares if the shares are in “street name” or by filling out an election card received from Computershare Investor Services shortly after the record date if the shares are in registered form. The bank, brokerage or nominee who holds the shares must advise the Depository Trust Company ("DTC") as to their full and fractional share requirements by March 23, 2011. Written notification for the election of cash instead of stock by registered shareholders must be received by Computershare Investor Services prior to March 23, 2011.

H&Q Healthcare Investors (NYSE:HQH - News) is a closed-end fund that invests in public and private companies in the healthcare industry. Hambrecht & Quist Capital Management LLC, based in Boston, serves as Investment Adviser to the Fund. Shares of the Fund can be purchased on the New York Stock Exchange through any securities broker.

Top holdings in this closed end fund:

Disclosure I am Long HQH shares.

This stock distribution will automatically be paid in newly issued shares of the Fund unless otherwise instructed by the shareholder. The shares will be valued at the lower of the net asset value or market price on the pricing date, March 24, 2011. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts at the transfer agent who will have whole and fractional shares added to their account.

Shareholders may request to be paid in cash instead of shares by responding to the bank, brokerage or nominee who holds the shares if the shares are in “street name” or by filling out an election card received from Computershare Investor Services shortly after the record date if the shares are in registered form. The bank, brokerage or nominee who holds the shares must advise the Depository Trust Company ("DTC") as to their full and fractional share requirements by March 23, 2011. Written notification for the election of cash instead of stock by registered shareholders must be received by Computershare Investor Services prior to March 23, 2011.

H&Q Healthcare Investors (NYSE:HQH - News) is a closed-end fund that invests in public and private companies in the healthcare industry. Hambrecht & Quist Capital Management LLC, based in Boston, serves as Investment Adviser to the Fund. Shares of the Fund can be purchased on the New York Stock Exchange through any securities broker.

Top holdings in this closed end fund:

| Holding | Value | %Portfolio | Teva Pharmaceutical Industries Ltd | $16.36M | 4.48% | Celgene Corporation | $16.18M | 4.43% | Amgen, Inc. | $13.91M | 3.81% | Gilead Sciences, Inc. | $12.11M | 3.32% | Forest Laboratories, Inc. | $12.07M | 3.31% | CVS Caremark Corporation | $11.83M | 3.24% | PerkinElmer, Inc. | $11.73M | 3.21% | WellPoint, Inc. | $10.53M | 2.88% |

|---|---|---|

| Repurchase Agreement, State Street Bank 0.01 | $10.34M | 2.83% |

| Aetna, Inc. | $10.02M | 2.75% |

| Align Technology, Inc. | $9.31M | 2.55% |

Disclosure I am Long HQH shares.

Friday, February 18, 2011

The Future of Build America Bond ETFs

Build America Bond issuance may surge next month, however, the Republican mid-term election gains could imperil the future of the program and its exchange traded funds (ETFs).

The Republican landslide in U.S. House elections may work against efforts to extend the Build America Bond program. President Barack Obama’s stimulus has helped pump $158 billion into local public-works projects, so there are many who would like to see this program continue.

There could be a savior to the program coming: The Investing In American Jobs and Closing Tax Loopholes Act — HR 5893 — would extend BABs for two years. Also, the legislation would gradually reduce the subsidy rate for BABs from the current 35% level to 32% for bonds sold in 2011, and 30% for those sold in 2012. BABS come in a range of maturities, from 1-5 years on up to more than 25 years.

The prospect of expiration isn’t stopping new issues. State and local governments are accelerating debt sales to December and will more than quadruple borrowing under the program. Build America Bond issuance may surge next month to $40 billion as borrowers rush to take advantage of the expiration, reports Alexandra Harris for Bloomberg.

If the program does expire, the number of bonds available in the market could be limited and may negatively impact the value of the bonds, so be mindful of this situation if you’re holding these funds. There are two ways to get exposure to Build America Bonds with ETFs:

Disclosure I am Long BAB and BABS shares.

The Republican landslide in U.S. House elections may work against efforts to extend the Build America Bond program. President Barack Obama’s stimulus has helped pump $158 billion into local public-works projects, so there are many who would like to see this program continue.

There could be a savior to the program coming: The Investing In American Jobs and Closing Tax Loopholes Act — HR 5893 — would extend BABs for two years. Also, the legislation would gradually reduce the subsidy rate for BABs from the current 35% level to 32% for bonds sold in 2011, and 30% for those sold in 2012. BABS come in a range of maturities, from 1-5 years on up to more than 25 years.

The prospect of expiration isn’t stopping new issues. State and local governments are accelerating debt sales to December and will more than quadruple borrowing under the program. Build America Bond issuance may surge next month to $40 billion as borrowers rush to take advantage of the expiration, reports Alexandra Harris for Bloomberg.

If the program does expire, the number of bonds available in the market could be limited and may negatively impact the value of the bonds, so be mindful of this situation if you’re holding these funds. There are two ways to get exposure to Build America Bonds with ETFs:

Disclosure I am Long BAB and BABS shares.

Intel (INTC) to Build $5B Facility in Arizona

Intel Corp. (NASDAQ: INTC) announced Friday that it plans to invest more than $5 billion to build a new chip facility at its site in Chandler, Arizona.

The announcement was made by Intel President and CEO Paul Otellini during a visit by President Barack Obama at an Intel facility in Hillsboro, Ore.

“The investment positions our manufacturing network for future growth,” said Brian Krzanich, senior vice president and general manager, Manufacturing and Supply Chain. “This fab will begin operations on a process that will allow us to create transistors with a minimum feature size of 14 nanometers. For Intel, manufacturing serves as the underpinning for our business and allows us to provide customers and consumers with leading-edge products in high volume."

The company said that the construction will begin in the middle of this year and is expected to be completed in 2013.

Disclosure I am long INTC shares.

The announcement was made by Intel President and CEO Paul Otellini during a visit by President Barack Obama at an Intel facility in Hillsboro, Ore.

“The investment positions our manufacturing network for future growth,” said Brian Krzanich, senior vice president and general manager, Manufacturing and Supply Chain. “This fab will begin operations on a process that will allow us to create transistors with a minimum feature size of 14 nanometers. For Intel, manufacturing serves as the underpinning for our business and allows us to provide customers and consumers with leading-edge products in high volume."

The company said that the construction will begin in the middle of this year and is expected to be completed in 2013.

Disclosure I am long INTC shares.

Ship Finance (SFL) Posts Q4 EPS of 49c; Raises Qtr. Dividend by 5.5% to 38c/Share

Ship Finance International Limited (NYSE: SFL) reported Q4 EPS of $0.49, $0.06 better than the analyst estimate of $0.43. Total operating sales came in at $71.2 million.

Raises its quarterly dividend by 5.5% from 36c to 38c/share.

Disclosure I am long SFL shares.

Raises its quarterly dividend by 5.5% from 36c to 38c/share.

Disclosure I am long SFL shares.

Abbott (ABT) Increases Quarterly Dividend 9% to $0.48

Abbott (NYSE: ABT) has declared a quarterly dividend of $0.48 per common share, $1.92 annualized. The dividend is a 9% increase from the current rate of $0.44.

The cash dividend is payable May 16, 2011, to shareholders of record at the close of business on April 15, 2011. The ex-dividend date is April 13, 2011.

Yield on the dividend is 4.1%.

Disclosure I am long abt shares.

The cash dividend is payable May 16, 2011, to shareholders of record at the close of business on April 15, 2011. The ex-dividend date is April 13, 2011.

Yield on the dividend is 4.1%.

Disclosure I am long abt shares.

New Asia ETF - ASEA

The other day we were discussing ETFs focusing on the BRIC Region (Brazil, Russia, India and China), so it's only fitting that we talk about a different region today, the Association of South Eastern Asian Nations (ASEAN).

The ASEAN region consists of Indonesia, Malaysia, Philippines, Singapore and Thailand. And if you want to invest in these regions as a whole, then you are only one new ETF away...

So if this fund sounds like a fit for your portfolio, you may want to check it out. As of today's close it was trading around $15.19.

Disclosure None

The ASEAN region consists of Indonesia, Malaysia, Philippines, Singapore and Thailand. And if you want to invest in these regions as a whole, then you are only one new ETF away...

- ASEA - Global X FTSE ASEAN 40 ETF

So if this fund sounds like a fit for your portfolio, you may want to check it out. As of today's close it was trading around $15.19.

Disclosure None

JPMorgan Boosts Dimon's Stock Pay 22% to $17.4 Million

JPMorgan Chase & Co., the second- largest U.S. bank by assets, boosted Chief Executive Officer Jamie Dimon’s 2010 restricted stock payout by 22 percent to $17.4 million.

The board awarded Dimon 251,415 restricted shares valued at about $12.1 million based on the Feb. 16 closing price, according to a filing yesterday with the U.S. Securities and Exchange Commission. He also received 367,377 options valued at $5.3 million, based on Bloomberg calculations.

That compares with 195,704 restricted shares valued at $7.95 million and 563,562 options valued at $6.24 million awarded last year for his work in 2009, according to disclosures by the New York-based company.

Dimon, 54, may have also received a cash bonus for 2010 as well that hasn’t yet been disclosed. He took a salary of $1 million and gave up bonuses for 2008 after receiving $49.9 million in total compensation for 2007, which included cash and restricted stock bonuses of $14.5 million each.

JPMorgan awarded Dimon’s top 15 executives more than $73 million in restricted shares, plus stock options, for their performance in 2010, according to Jan. 21 SEC filings. That compares with $64.2 million in stock granted to his top 16 executives a year ago, filings at the time show.

JPMorgan reported a record $17.4 billion profit for the year, buoyed by $7 billion in pretax reserves that were added back to earnings as credit quality and the U.S. economy improved. JPMorgan’s shares rose 1.8 percent during the year.

A majority of Dimon’s wealth is in JPMorgan stock. He and his wife owned directly or through trusts and retirement plans more than 5 million shares valued at more than $221 million as of Jan. 19, when his total holdings were last disclosed.

Jes Staley, 54, CEO of the investment bank, received the second-biggest share of JPMorgan’s compensation pool with $8 million in restricted shares and 230,770 stock options, the filings show. Chief Investment Officer Ina Drew, 54, got the next-highest payout with $7.4 million in restricted shares and 153,847 options.

Disclosure None

The board awarded Dimon 251,415 restricted shares valued at about $12.1 million based on the Feb. 16 closing price, according to a filing yesterday with the U.S. Securities and Exchange Commission. He also received 367,377 options valued at $5.3 million, based on Bloomberg calculations.

That compares with 195,704 restricted shares valued at $7.95 million and 563,562 options valued at $6.24 million awarded last year for his work in 2009, according to disclosures by the New York-based company.

Dimon, 54, may have also received a cash bonus for 2010 as well that hasn’t yet been disclosed. He took a salary of $1 million and gave up bonuses for 2008 after receiving $49.9 million in total compensation for 2007, which included cash and restricted stock bonuses of $14.5 million each.

JPMorgan awarded Dimon’s top 15 executives more than $73 million in restricted shares, plus stock options, for their performance in 2010, according to Jan. 21 SEC filings. That compares with $64.2 million in stock granted to his top 16 executives a year ago, filings at the time show.

Blankfein, Gorman

Goldman Sachs Group Inc. gave Chairman and Chief Executive Officer Lloyd Blankfein a $12.6 million stock bonus for 2010. The New York-based firm also raised Blankfein’s salary to $2 million from $600,000. James Gorman, Morgan Stanley’s top executive since January 2010, got deferred stock and options valued at about $7.4 million for his performance last year.JPMorgan reported a record $17.4 billion profit for the year, buoyed by $7 billion in pretax reserves that were added back to earnings as credit quality and the U.S. economy improved. JPMorgan’s shares rose 1.8 percent during the year.

A majority of Dimon’s wealth is in JPMorgan stock. He and his wife owned directly or through trusts and retirement plans more than 5 million shares valued at more than $221 million as of Jan. 19, when his total holdings were last disclosed.

Jes Staley, 54, CEO of the investment bank, received the second-biggest share of JPMorgan’s compensation pool with $8 million in restricted shares and 230,770 stock options, the filings show. Chief Investment Officer Ina Drew, 54, got the next-highest payout with $7.4 million in restricted shares and 153,847 options.

Disclosure None

CF Industries Q4 Profit Beats View on Rising Fertilizer Demand (CF)

Fertilizer maker CF Industries Holdings, Inc. (CF) late Thursday posted better-than-expected fourth quarter earnings results, aided by strong demand for its products and the addition of sales from its acquisition of rival Terra Nitrogen(TNH).

The Deerfield, IL-based company reported fourth quarter net income of $200.3 million, or $2.78 per share, compared with $51.4 million, or $1.04 per share, in the year-ago period. Excluding one-time items, adjusted profit was $2.65 per share.

Revenue more than doubled from last year to $1.24 billion.

On average, Wall Street analysts expected a smaller profit of $2.56 per share, on lower revenue of $1.19 billion.

CF Industries shares fell 81 cents, or -0.6%, in premarket trading Friday.

The Bottom Line

CF Industries (CF) has been an “aggressive” recommendation, but is not a name I think yield-focused investors should be considering. The company has a .27% dividend yield, based on last night’s closing stock price of $147.81.

Disclosure I am Long TNH shares.

The Deerfield, IL-based company reported fourth quarter net income of $200.3 million, or $2.78 per share, compared with $51.4 million, or $1.04 per share, in the year-ago period. Excluding one-time items, adjusted profit was $2.65 per share.

Revenue more than doubled from last year to $1.24 billion.

On average, Wall Street analysts expected a smaller profit of $2.56 per share, on lower revenue of $1.19 billion.

CF Industries shares fell 81 cents, or -0.6%, in premarket trading Friday.

The Bottom Line

CF Industries (CF) has been an “aggressive” recommendation, but is not a name I think yield-focused investors should be considering. The company has a .27% dividend yield, based on last night’s closing stock price of $147.81.

Disclosure I am Long TNH shares.

ETF Showdown: Timber Time

In the world of timber ETFs there are two. Yep, just two. Not even an ETN, which is strange considering there are timber futures trading here in the U.S., but we've got to focus on the options we do have access to and these two funds will be the focus of this week's ETF Showdown.

Like gold, coffee or oil, timber is a commodity and like so many other commodities, emerging markets demand is the driving force in the timber market. As ETFTrends recently pointed out, China is gobbling up pallets and packing materials, pulp and paper at rapid pace with no signs of a change in trend anytime soon.

Sounds like a good time to compare and contrast the Guggenheim Timber ETF (NYSE: CUT) and the iShares S&P Global Timber Index Fund (NYSE: WOOD). Kudos to both Guggenheim and iShares for coming up with appropriate tickers. Making distinctions between CUT and WOOD is critical for investors because over the past year, the performance of these ETFs is identical as both are up 30%.

First, we see that CUT trades for less than half the price of WOOD, allowing a trader to accumulate more than double the amount of shares for the same outlay of capital. So there's a point in CUT''s favor. CUT also features the better liquidity with an average daily trading volume for the past three months that is better than quadruple what WOOD features.

On the other hand, WOOD does offer the better expense ratio at 0.48% compared to 0.65% for CUT. Obviously both funds are going to have some of the same holdings, but the allocations are different because WOOD is nearly half allocated to the U.S. while about a quarter of CUT's allocation is devoted to the U.S. Either way, you'll see Rayoneir (NYSE: RYN), Weyerhaeuser (NYSE: WY) and MeadWestvaco (NYSE: MV) among the top 10-holdings for both ETFs. International Paper (NYSE: IP )is found among CUT's top-10, but not WOOD's.

Making a decision between these two funds is hard, but it is clear timber exposure is worth a look now. Over the last 30 years or more, there has been little or no positive correlation between the returns generated from timberland and those from either fixed-income or equity assets, according to Hard Assets Investor.

A long-term hold might want to opt for WOOD because of the lower expense ratio, but an active trader should go for CUT because of the of the superior liquidity. Consider this showdown a draw with a slight edge to CUT.

Like gold, coffee or oil, timber is a commodity and like so many other commodities, emerging markets demand is the driving force in the timber market. As ETFTrends recently pointed out, China is gobbling up pallets and packing materials, pulp and paper at rapid pace with no signs of a change in trend anytime soon.

Sounds like a good time to compare and contrast the Guggenheim Timber ETF (NYSE: CUT) and the iShares S&P Global Timber Index Fund (NYSE: WOOD). Kudos to both Guggenheim and iShares for coming up with appropriate tickers. Making distinctions between CUT and WOOD is critical for investors because over the past year, the performance of these ETFs is identical as both are up 30%.

First, we see that CUT trades for less than half the price of WOOD, allowing a trader to accumulate more than double the amount of shares for the same outlay of capital. So there's a point in CUT''s favor. CUT also features the better liquidity with an average daily trading volume for the past three months that is better than quadruple what WOOD features.

On the other hand, WOOD does offer the better expense ratio at 0.48% compared to 0.65% for CUT. Obviously both funds are going to have some of the same holdings, but the allocations are different because WOOD is nearly half allocated to the U.S. while about a quarter of CUT's allocation is devoted to the U.S. Either way, you'll see Rayoneir (NYSE: RYN), Weyerhaeuser (NYSE: WY) and MeadWestvaco (NYSE: MV) among the top 10-holdings for both ETFs. International Paper (NYSE: IP )is found among CUT's top-10, but not WOOD's.

Making a decision between these two funds is hard, but it is clear timber exposure is worth a look now. Over the last 30 years or more, there has been little or no positive correlation between the returns generated from timberland and those from either fixed-income or equity assets, according to Hard Assets Investor.

A long-term hold might want to opt for WOOD because of the lower expense ratio, but an active trader should go for CUT because of the of the superior liquidity. Consider this showdown a draw with a slight edge to CUT.

Disclosure None

Four ROOKIE Investor ETF Investing Mistakes

Investors are at last beginning to return to the equity markets, and ETFs are slated to play a bigger role than ever before. Wary of mutual fund managers and conscious of tax implications, many sidelined investors will be drawn to ETF strategies that promise to mitigate security-specific risk while maximizing exposure to particular assets.

However, when it comes to structure, pricing and trading, these products are more complex than most investors initially realize. Whether you're a first-time ETF investor or just looking to use ETFs in a way you haven't tried before, here are four "rookie" mistakes that can be easily avoided.

Nevertheless, there are times when somewhat-illiquid products offer compelling longer-term opportunities, and investors may want to get involved. The biggest mistake an ETF investor can make when placing an order in an illiquid ETF is to designate that trade as a "market order." Since market orders are concerned with immediate execution first (and price second), these are exactly the type of transactions that result in the most severe ETF pricing dislocations. If you need to place an order in an illiquid ETF, use a limit order at, or near, the last sale instead.

Leveraged ETFs are designed for sophisticated investors and are effective in certain trading strategies. After several regulatory inquiries and lawsuits, they are now plastered with warnings (but still are often misused). The best rule of thumb: If you don't understand how an ETF achieves its objective, pick a different product.

Though the most liquid funds in the ETF universe (SPDR S&P 500 ETF(SPY_) and SPDR DJIA ETF(DIA_)) can change hands with ease throughout the trading day, other, less liquid ETFs are easier to trade at certain times during the trading day (without causing pricing dislocation).

Volume-wise, the two busiest times for ETF trading in a "normal" trading session (one that isn't shortened or impacted by the release of major economic data) generally occur between 9:30 a.m. EST and 11:30 a.m. EST and between 2:30 p.m. EST and 4:00 p.m. EST.

This information is important to know if you're looking to trade products actively without causing price dislocation. The best time to trade an ETF is when there are plenty of other investors interested in buying and selling the same fund. When you are looking to trade in an active manner (or trade a fund that isn't the biggest ETF on the block), make sure that time is on your side.

Disclosure I am long SPY,DIA and VWO.

However, when it comes to structure, pricing and trading, these products are more complex than most investors initially realize. Whether you're a first-time ETF investor or just looking to use ETFs in a way you haven't tried before, here are four "rookie" mistakes that can be easily avoided.

1. Placing a Market Order in an Illiquid Fund

With more than 1,000 products in the exchange-traded product universe, some funds have drawn copious amounts of attention while others -- sometimes seemingly inexplicably -- fail to attract investor interest. These lightly traded funds can be particularly dangerous to new ETF investors because liquidity is important to the pricing of exchange traded funds. If an ETF is lightly traded, it can easily be thrown off track by an unexpectedly large order that causes market price to deviate from underlying value. No one wants to buy an ETF at a premium only to sell it at a discount when things go bad.Nevertheless, there are times when somewhat-illiquid products offer compelling longer-term opportunities, and investors may want to get involved. The biggest mistake an ETF investor can make when placing an order in an illiquid ETF is to designate that trade as a "market order." Since market orders are concerned with immediate execution first (and price second), these are exactly the type of transactions that result in the most severe ETF pricing dislocations. If you need to place an order in an illiquid ETF, use a limit order at, or near, the last sale instead.

2. Using Leveraged Funds in the Wrong Situation

The most important aspect of leveraged fund construction is that the majority of "leveraged," "ultra" and "3x" ETFs are designed to track daily objectives. Whether the objective is to track the financial sector or the price of gold, these funds track their underlying indices for a single trading session only before "resetting" to do the same thing the next day. Whether you're using the Direxion Daily Financial Bear 3X Shares(FAZ_) or the ProShares UltraShort Real Estate ETF(SRS_), if you hold a leveraged fund over time, you will encounter compounding that skews longer-term results.Leveraged ETFs are designed for sophisticated investors and are effective in certain trading strategies. After several regulatory inquiries and lawsuits, they are now plastered with warnings (but still are often misused). The best rule of thumb: If you don't understand how an ETF achieves its objective, pick a different product.

3. Missing the Forest Because of the Trees

Many investors try to maintain longer-term portfolios while simultaneously profiting from targeted short-term positions. While this is a great use of the variety and scope of the ETF products currently available, it's easy to forget to look below the surface and monitor how these different positions interact. ETF portfolios overlap, and investors who aren't careful about monitoring overall exposure can often develop unintended pockets of concentration in their portfolios. When two popular funds like the Vanguard MSCI Emerging Markets ETF(VWO_) and the iShares Emerging Markets ETF(EEM_) share so many of the same components, sometimes it's best to just stick with a single position.4. Forgetting About the Clock