MLPs have a different structure from most publicly traded companies. Instead of being structured as corporations, they are structured as limited partnerships. This has some big tax advantages, but can also create some tax filing complications. Be sure that you understand the MLP structure well before buying any units.

To be considered for inclusion in the following list, an MLP was required to be in the midstream business, have a debt/equity ratio below 200%, and have a current ratio above 1. From there I looked for a combination of low valuations, high profitability, high payout ratio adjusted distributions and distribution growth. Below are the five MLPs that I think best fit those criteria.

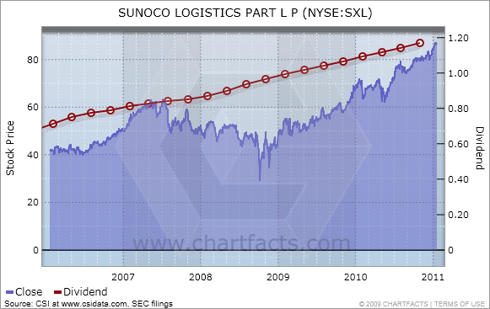

Sunoco Logistics Partners L.P. (SXL)

Sunoco Logistics transports and stores crude oil and refined petroleum products for customers in major activity centers in the Northeast, Midwest and Gulf Coast regions of the United States. The company also buys crude oil from U.S. domestic producers and sells it to refiners.

Dividend Yield: 5.47%

Payout Ratio: 48%

5 Yr Dividend Growth: 12.73%

Enterprise Value/Operating Cash Flow: 18.29

Total Debt to Equity: 140.76%

Current Ratio: 1.16

Return on Investment: 15.97%

Click to enlarge

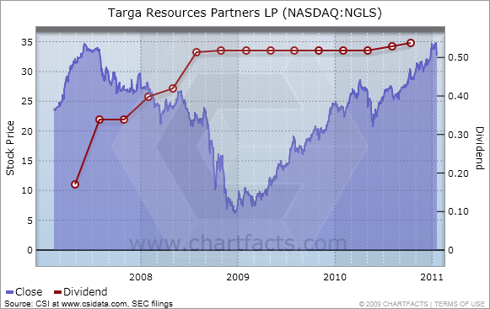

Targa Resources Partners LP (NGLS)

Targa Resources Partners is a Delaware limited partnership engaged in the business of gathering, compressing, treating, processing and selling natural gas and storing, fractionating, treating, transporting and selling natural gas liquids, or NGLs, and NGL products. The partnership owns an extensive network of integrated gathering pipelines and gas processing plants and currently operates along the Louisiana Gulf Coast, accessing the coastal and offshore region of Louisiana, the Permian Basin in West Texas and Southeast New Mexico and the Fort Worth Basin in North Texas. Additionally, the company's natural gas liquids logistics and marketing assets are located primarily at Mont Belvieu and Galena Park near Houston, Texas, and in Lake Charles, Louisiana, with terminals and transportation assets across the United States. Targa Resources Partners is managed by its general partner, Targa Resources GP LLC, which is indirectly wholly owned by Targa Resources Corp. (TRGP).

Dividend Yield: 6.37%

Payout Ratio: 176%

5 Yr Dividend Growth: N/A

Enterprise Value/Operating Cash Flow: N/A

Total Debt to Equity: 146.44%

Current Ratio: 1.13

Return on Investment: 6.04%

Click to enlarge

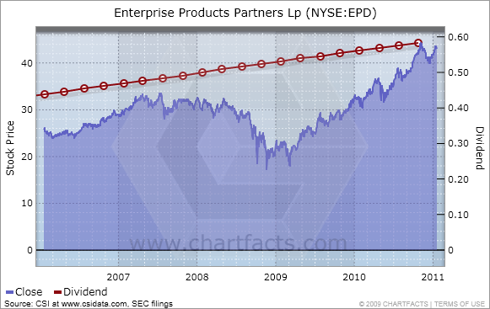

Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners L.P. (Enterprise Products Partners) is a North American midstream energy company providing a range of services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, refined products and certain petrochemicals. In addition, the company is engaged in the development of pipeline and other midstream energy infrastructure in the continental United States and Gulf of Mexico.

Dividend Yield: 5.5%

Payout Ratio: 109%

5 Yr Dividend Growth: 7.73%

Enterprise Value / Operating Cash Flow: 16.75

Total Debt to Equity: 123.25%

Current Ratio: 1.01

Return on Investment: 8.06%

Click to enlarge

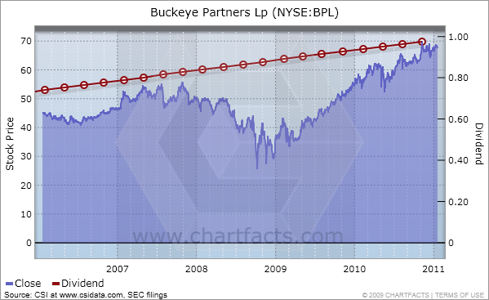

Buckeye Partners, L.P. (BPL)

Buckeye Partners, L.P. is a publicly traded partnership that owns and operates one of the largest independent refined petroleum products pipeline systems in the United States in terms of volumes delivered, with approximately 5,400 miles of pipeline; owns 69 active refined petroleum products terminals; operates and maintains approximately 2,400 miles of pipeline under agreements with major oil and chemical companies; owns a major natural gas storage facility in northern California; and markets refined petroleum products in certain of the geographic areas served by its pipeline and terminal operations.

Dividend Yield: 5.78%

Payout Ratio: 101%

5 Yr Dividend Growth: 6.86%

Enterprise Value / Operating Cash Flow: 17.93

Total Debt to Equity: 144.97%

Current Ratio: 1.3

Return on Investment: 8.94%

Click to enlarge

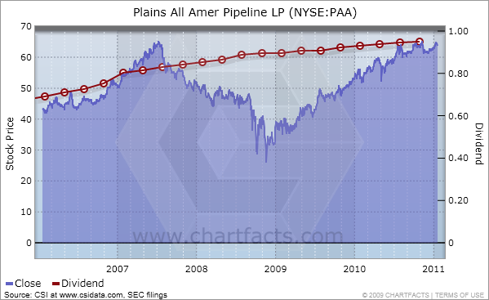

Plains All American Pipeline, L.P. (PAA)

Plains All American Pipeline, L.P. is a publicly traded master limited partnership (“MLP”) engaged in the transportation, storage, terminalling and marketing of crude oil, refined products and liquefied petroleum gas and other natural gas related petroleum products (together "LPG"). Through its general partner interest and majority equity ownership position in PAA Natural Gas Storage, L.P. (PNG), the company also is engaged in the development and operation of natural gas storage facilities.

Dividend Yield: 6.04%

Payout Ratio: 167%

5 Yr Dividend Growth: 9%

Enterprise Value / Operating Cash Flow: 29.24

Total Debt to Equity: 133.5%

Current Ratio: 1.06

Return on Investment: 5.46%

Click to enlarge

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Some excellent suggestions

ReplyDelete