The Industrials Select Sector SPDR (XLI) was recently up 15% on the year, putting it about 750 basis points ahead of the S&P 500 SPDR (SPY). The Utilities SPDR (XLU) is down almost 4% so far on the year, putting it nearly 20% behind the Industrials SPDR.

The industrial sector is one of the most assorted corners of the U.S. economy, including aerospace & defense stocks, railroads, electrical equipment, construction and engineering, airlines, and good old-fashioned conglomerates. So putting a finger on the exact source of the rally is a bit challenging; rather, there are a number of factors contributing to the big run-up in the industrial sector this year. After making significant cost cuts during the downturn, profit margins have spiked following even moderate increases in revenue. Demand for products from emerging markets has surged, with the BRIC economies snapping up everything from small machinery to airplanes. Moreover, early cycle markets in the U.S. are rallying as consumer spending picks up once again.

As business activity has picked up, several industrial sub-sectors have received a nice boost. Many homebuilders have bounced back from the brink of collapse, while a resurgence in the airline industry (prior to the recent shutdown following Iceland’s volcanic eruption at least) has given a boost to stocks battered during the downturn. Dozens of industrial companies have reported impressive earnings and lifted full year outlooks in recent weeks, citing strong global demand for their products as the primary drivers.

Industrials ETFs In Focus

For investors expecting the industrials rally to continue, there are a number of ETF options that offer exposure to this sector (see all ETFs in the Industrials Equities ETFdb Category).- Industrials Select Sector SPDR (XLI): This ETF is one of the largest industrials ETFs, tracking the performance of the Industrials Select Sector Index. A look at the largest components illustrates the diversity of the companies included in the industrials sector; big holdings include General Electric, UPS, 3M, Union Pacific, Caterpillar, and Boeing. XLI is up about 16% already on the year and charges an expense ratio 0f 0.21%.

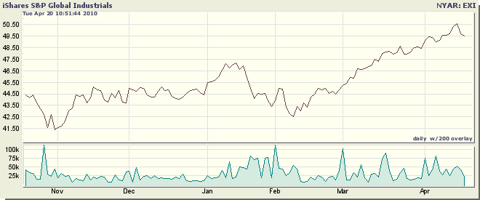

- iShares S&P Global Industrials (EXI): For investors looking to achieve global exposure to the industrial sector, EXI is an interesting option. U.S. equities account for just under 50% of holdings, with Japan, France, and Germany representing the largest international allocations. EXI has about 180 components and charges 0.48%.

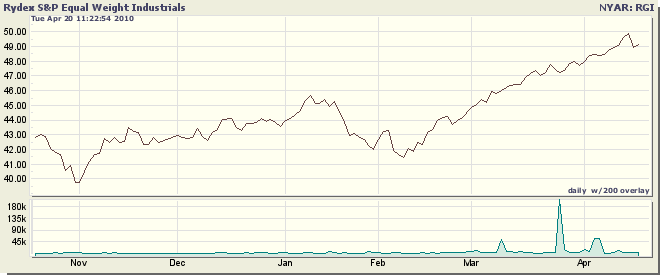

- Rydex S&P Equal Weight Industrials (RGI): This ETF presents a twist on traditional cap-weighted ETFs, giving each industrial company in the S&P 500 an equal weighting. So RGI gives the same weighting to General Electric as it does to Cintas, a potentially attractive feature for investors who believe cap-weighting strategies are inherently flawed.

Other Options

Other ETFs offering exposure to the industrial sector include:- Global X China Industrials ETF (CHII): Targets the industrial sector of the Chinese economy.

- PowerShares S&P SmallCap Industrials Portfolio (XLIS): Consists of industrials companies included in the S&P SmallCap 600.

- iShares Dow Jones U.S. Aerospace & Defense Index Fund (ITA): Offers exposure to defense companies and manufacturers of aircraft and aircraft parts.

Excellent post on another outstanding Exchange traded fund.

ReplyDelete