Industry overview

The dry bulk shipping industry is driven by a variety of factors. The main factors (in order of importance) are:

1. Commodity Demand

2. Fleet Supply

3. Fuel prices

4. Weather

The volatility of these factors makes the dry bulk shipping a cyclical industry. The factors listed above led to a boom in 2007/2008. China's seemingly insatiable demand for dry bulk goods, particularly iron ore was the main driving factor. From late 2006 to late 2007, Diana's stock price returned 300%. However, as it turns out, China's demand was eventually satisfied and the industry went bust late in 2008. Subsequently, Diana's stock price fell about 60%.

The last couple years have been sluggish for shipping. What's worse is that shipping isn't out of the woods yet. There are more worries for the future of dry bulk shipping. This article from Morningstar gives a good overview of the industry. One would think that an industry whose forecast is fraught with fears would be an unattractive investment. I would argue otherwise. To quote Buffett, "Be fearful when others are greedy, greedy when others are fearful". The fear surrounding the shipping industry presents a great opportunity for investment.

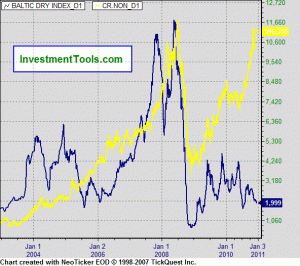

As mentioned above, commodity prices have a large impact on the shipping industry. Below is a graph plotting the BDI (A measure of shipping prices) against the CRB index (a measure of commodity prices):

[click to enlarge]

From 2002-2009 there was a modest relationship between commodity prices and shipping rates. The rationale behind the relationship is as follows: As demand for commodities increases, the price increases. The buyers and sellers of the commodities need to transport the commodities to each other, thus demand for shipping increases subsequently raising shipping rates.Starting in 2010, the relationship ceased to exist. Commodities and shipping started moving in opposite directions. A couple of reasons that prices may be staying low is because of an increasing supply of vessels, and the increasing price of crude oil. However, the high oil prices in 2007/08 didn't seem to slow down shipping rates. That being said, the only factor contributing to low shipping rates is the oversupply of vessels. I think this factor is overplayed. While vessel supply is expected to grow in the 10-12% range from 2009-2011, vessel scrapping is also on the rise. This will partially offset the increased supply in vessels. All things considered, I believe today's shipping prices are artificially low. Increasing commodity demand should increase shipping, leading to an increase in shipping rates.

Company overview

When people think bulk dry shipping, they think of shipping iron ore and coal. This is a major part of the industry, but does not contribute as much to Diana's bottom line as it does to its competitors. Based on Diana's fleet composition and major customers, it would appear that Diana is mainly focused on the supply of grain and wheat. Diana's fleet is comprised primarily of medium sized vessels. Medium and small sized vessels are used for shipping mainly iron ore, coal, and grains. A benefit of smaller ships is that they are the more economically efficient for transporting grains. The downside of medium-sized vessels (as compared to larger vessels) is that they don't benefit from the same economies of scale from transporting iron ore. Over the past few years, Diana's largest customers have been Cargill, BHP (BHP), The Australian Wheat board, and China National. These customers have represented approximately 35-50% of revenues. Based on these customers, it would appear that a sizable portion of Diana's revenue is derived from wheat.

In terms of commodities, Diana is more diversified than other shippers. This lowers the reliance on any one commodity and lowers the overall business risk. Based on the major competitors, it appears that a lot of Diana's business is coming from the Australian-China trade route. This could have a positive short-term impact on Diana, as Australia had an above average wheat harvest this year.

Diana shipping has been investing heavily in purchasing a new ships. Capital expenditures were ramped up in 2007/2008. Today, Diana has the youngest fleet in the industry. This is beneficial because newer ships benefit from improved fuel efficiency. In the face of rising oil prices, Diana will have a competitive advantage over its peers.

Revenue has seen inconsistent high growth. Diana's revenue has a 5-year average growth rate of 30.25%, including a large decrease in 2009. Operating income growth is a bit lower, but a similar story. Net income has been a bit more volatile. It showed slow growth prior to 2007, a large increase in 07/08, and has been back to '07 levels for the past two years. Inconsistent income is a bad sign, but a necessity of a highly cyclical industry.

Diana's financials are in good shape. Diana has a strong balance sheet, which is a must-have in a highly cyclical industry. The company's iquidity is the highest in the industry, and debt is the lowest. Because of a low level of leverage, Diana will benefit less in the boom cycle, but will fare better in a bust cycle. Considering a great deal of uncertainty in the future of dry bulk shipping, I think Diana Shipping is a safe bet.

Diana Shipping benefits from a strong management team. Management has been making decisions that are favorable for shareholders. The 5-year average ROA, ROE, and ROI metrics are 16.8%, 17.16%, and 20.86%, respectively. These are all well above the industry average, and very respectable numbers for any industry. Share purchases and buybacks are also in line with shareholders' interests. In 2007 Diana's stock price was trading in the $16.50-$42.50 range. During this time, management was aggressively selling its shares and using these proceeds to buy ships. It also paid nearly all of its net income through dividend payments. Management was rationally cashing in when the times were good, as if preparing for a slowdown. Well, that slowdown happened. After the booming shipping industry went bust in late 2008, Diana stopped selling stock, and stopped paying dividends.

In May 2010, management initiated a share buyback program for $100M, or 10% of its market capitalization. It would appear that management felt DSX stock price was undervalued in the $13-14 range. Today they are trading at $12.02. It is great to see a management team that has a track record of good decisions for shareholders. It is also a great to see management signaling to the market that DSX is undervalued by buying back shares. It would seem we both agree that DSX is undervalued.

Valuation

Diana is trading below its fair value. At a price of $12.02, it is trading at 7.92 P/E and 6.10 EV/EBITDA. These are average for the industry, and low by historical standards. During the boom of 2008, DSX was trading at double today's valuation multiples.

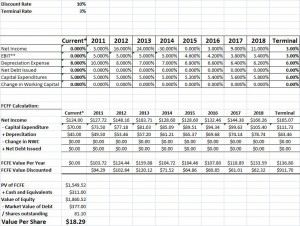

I ran a discounted cash flow analysis on DSX. Please click on the image below to view my assumptions/calculations;

[click to enlarge]

My profit assumptions are in line with the cyclical nature of the business, aka: volatile swings in net income. Capital expenditure and depreciation assumption are based on the implications of recent capital expenditure. I obtain an intrinsic price of $18.29. The current market price is $12.02, offering a margin of safety equal to 34.28%.

Conclusion

The future of the dry bulk shipping industry is uncertain. What is certain, is that shipping is a cyclical industry, and has been suffering tremendously in the past couple years. Macroeconomic trends suggest that a recent surge in commodity prices should have increased shipping rates. This has not happened, and the dry bulk shipping industry stands to increase from catch-up in shipping rates to commodity prices. Diana Shipping has a diverse commodity shipping profile, with higher than average focus on grains.

In terms of financials, Diana Shipping has low leverage, and high profitability. Management has shown good performance through capital allocation decisions, impressive return on capital, and recent share buybacks. The stock price took a massive 60% tumble in late 2008 and while the rest of the market has recovered, it has stayed depressed. Today, Diana is an industry leader that is valued similarly amongst its competitors. By historical standards, it's trading at half of its valuation from its early 2008 highs. A discounted free cash flow analysis shows DSX exhibited a large margin of safety. An investment in Diana Shipping at $12.02 presents an opportunity of above industry average returns if dry bulk shipping remains grim, and great returns in the event of a turnaround in shipping.

Disclosure: I do not OWN DSX.

My Map Book by Sara Fanelli – A lovely book full of creative maps. https://imgur.com/a/yk3dCQI https://imgur.com/a/yqdpb7O https://imgur.com/a/Ne3DoGD https://imgur.com/a/PHUztmK https://imgur.com/a/Th93xup https://imgur.com/a/cCJE02c https://imgur.com/a/Jo5B7YH

ReplyDelete