Fiscal 2010 segment results ($ figures in billions) were:

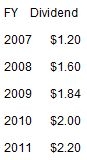

Dividends have been increased annually since 1977, easily qualifying CLX as an S&P 500 Dividend Aristocrat. Last May, the quarterly dividend was increased to 55¢ ($2.20 annualized).

Recent dividend history:

The markets were disappointed with fiscal Q1 results reported in November 2010, causing the low beta stock to drop $4 in 3 days. CLX said:

We faced a challenging economic environment, as evidenced by category softness in the U.S. along with the impact of the Venezuela currency devaluation," said Chairman Don Knauss. "Late first-quarter shipments were particularly soft and that trend has continued into the first weeks of our second quarter. While we're disappointed not to have delivered stronger first-quarter results, we manage our business for the long term. I believe we're taking the right actions to maintain the long-term health of our brands and help strengthen our categories as the economy recovers.Company guidance given for FY2011 was:

- 0-2% sales growth

- 25-50 basis points gross margin growth (unchanged)

- Diluted EPS from continuing operations in the range of $4.05-$4.20

While second quarter sales results are likely to be a little lower than previously anticipated, as reflected in our updated full year sales outlook, we believe our categories are stabilizing, giving us momentum into the second half of the year, and we should benefit from our recent market share gains. We have a solid new-product pipeline, enabling further growth across a number of categories, and we anticipate improved performance in the second half of the year, including topline growth in the range of 2 percent to 4 percent. Further, the impact of the prior-year Venezuela devaluation and unusually strong year-ago H1N1-related sales will be behind us.Q2 will have a goodwill impairment charge of $250-255 million ($1.78-1.82 diluted EPS) related to Burt's Bees business (with no tax benefit expected). In November 2010, CLX completed the sale of Auto Care businesses with an anticipated after-tax gain of $171 million. Including the $60 million deferred tax benefit in fiscal Q1, the gain on the sale is expected to be $231 million (reflected in discontinued operations).

Leading household brands at CLX are growing at modest rates in the US and rapidly overseas. In the last 6 years, international sales have been growing 2-3 times the rate of domestic sales. 58% of international sales come from Latin America and only 5% are in Asia (offering large growth potential). International business is expected to account for a substantial portion of future growth

Company EPS guidance for FY2011 remains $4.05-$4.20. Fiscal Q2 results and any guidance updates will be released in the first week of February. Analysts are forecasting EPS of $4.00 in FY2011 and $4.48 for next year. Company finances remain strong, especially after selling the AutoCare businesses which will provide funds to repurchase over 12 million shares of treasury stock in FY2011.

In the last 6 years the stock has largely traded in the $55-65 range while dividends have been growing. At $65, with a P/E of 13X and a yield of 3.4% (the dividend will be raised in May), long term investors who can tolerate current conditions should find CLX an attractive investment.

Disclosure I am long CLX shares.

Nice analysis. Clorox has a great portfolio of products and a reasonable price. If they can expand into Asia like they have in L. America, there could be some great long term growth potential.

ReplyDelete